Wealth Robo

Wealth Robo allows you to offer the same superior quality service as traditional advice with the efficiency of an automated approach.

Driving wealth democratization

and easy future planning

Your wealth management clients can easily invest lower value funds or decumulate their investible assets to support their instant or longer term financial plans.

Grow your business and clients

Your business can reach out to more clients for less without compromising relationships.

Cost-effectively access previously financially unviable markets

Retain clients and acquire next generation clients by avoiding the shift of available assets

Encourage online and remote interaction, previously only available through a personal advisor

Ensure services become central to a client’s financial affairs by enabling intelligence-driven interaction

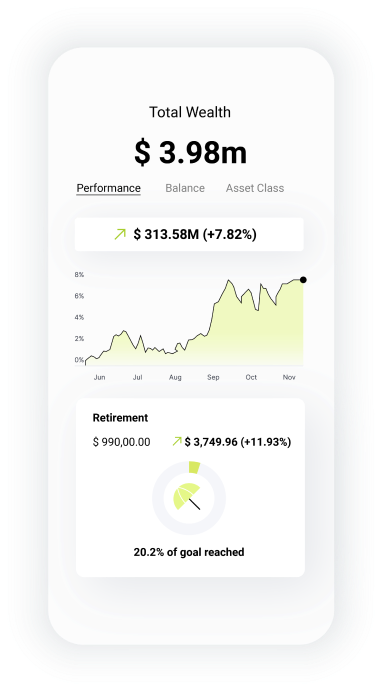

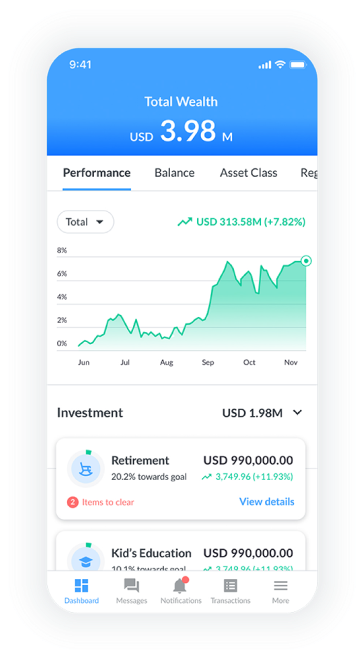

Enhance your client experience

Offer self-service, remote chat with an advisor or via call-center, screen sharing and phone-in.

Manage all products with person-to-person advice, self-service, or via call-center, screen sharing and phone-in from anywhere, at anytime (24/7)

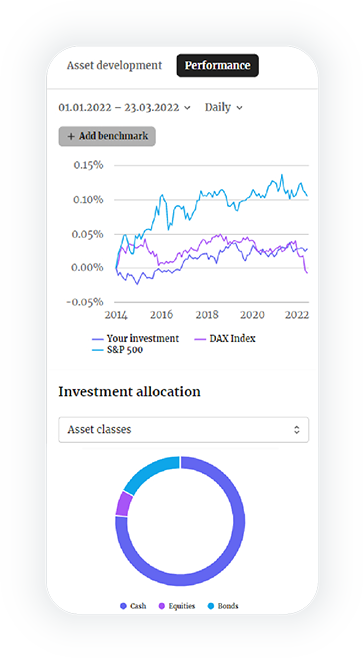

View investment simulations and guide savings decisions with thoughtful automation to encourage financial control and well-being

Continually monitor performance of portfolios and evolution of goals in real-time, with actionable alerts and associated advice

Support the democratization of wealth by giving wider client segments, with lower investable assets, access to the same products as HNWIs

How additiv helped Commonwealth

Bank Indonesia

Commonwealth Bank Indonesia wanted to provide their customers with a better, more inclusive wealth management service. As one of the banks that has the biggest number of mutual funds holders, the bank looked for a solution to serve their customers in a standardized and efficient manner.

additiv enabled Commonwealth Bank Indonesia to be the first bank to launch a wealth management mobile app in Indonesia.

Speak with an expert

Book a session with digital wealth, embedded finance

or technology experts.