This article first appeared on Hubbis.com on April 7th, 2021

Wealth management in APAC is changing fast – we need new maps to guide us

As a European living in Asia Pacific, the dynamism of this region is rarely lost on me. It is the most populous region in the world, the fastest growing, the most digitally savvy and, since 2016, also the largest market for wealth management.

Asia is by extension a great barometer, and leading indicator of, digital transformation. What is happening in Asia now – especially within digital wealth management – will come to the rest of the world over coming years.

A significant shake-up in the value chain

Looking at the Asian market today, what can we discern about the future of wealth management? Well, the traditional model of the universal, vertically integrated private bank and wealth manager is fast becoming obsolete. In Indonesia, where I live, the majority of Indonesians are more likely to consume digital wealth management services from the likes of Go-Jek, a super app, than from a dedicated wealth manager.

The fact is that the whole banking-as-a-service phenomenon, which describes how banking services get embedded into third-party distribution channels, has been playing out in Asia for many years already. The fight for customer attention (and trust), which will determine who distributes financial services, has run several rounds already and it tells us a lot about the emerging wealth landscape.

A business model perspective is essential for strategic planning

Last year, the wealth management industry spent billions on digital transformation. However, the problem was that most of these projects were taken on a tactical basis, solving specific pain points (including upgrading core wealth banking systems), without taking a holistic view of wealth managers’ strategic priorities.

What developments in the Asian markets show us is digitization drives a wedge between the distribution and manufacturing of financial services. Firms must decide on which side of the dividing line they wish to be. This requires taking a business model approach to strategic planning.

The dilemma’s are increasingly clear: aggregate demand, aggregate supply or be aggregated. That is to say, a wealth manager has to decide to use the pull of its client base to offer third party services, leverage the economies of scale of its regulated platform to allow WealthTech players like additiv to build or embed wealth management services, or to produce highly specialized services that are distributed through others.

To some extent, these are not mutually exclusive options: a bank like Standard Chartered with its Nexus BaaS platform, its crypto custody business Zodia and its neobank Mox is executing many of these strategies all at once. But, whether a uniform strategy or different strategies across a group, taking a business model approach to strategic planning is essential and urgent.

We need a new map

Once a private bank or asset manager decides where it wants to operate in the value chain and what business model it wishes to execute, it then needs to look at wealth management system selection. To look at systems before business models is to put the cart before the horse; a decision that will, at best, impose downstream constraints and, at worse, undermine all value creation.

The challenge is to know what wealth management systems to select. Whereas wealth managers have seldom looked at system selection through a business model lens, the consultants and industry analysts that serve them have seldom done so either. This leaves a dearth of reliable research on which to base decisions.

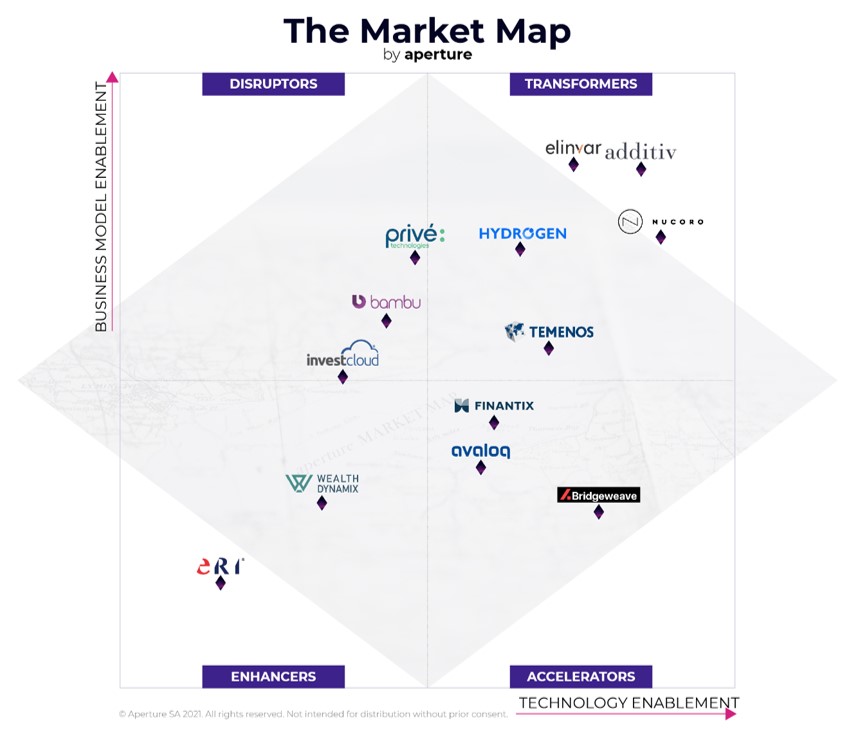

There is one notable exception, however. A Geneva-based consultancy called aperture has recently published a new methodology for assessing wealth management software vendors based on two main criteria: technology enablement(the extent a solution enables firms to introduce technologies that can transform customer experience) and business model enablement (the extent to which a solution can enable firms to transform their business models). The methodology is called The Market Map, first applied to the wealth management market, it offers a new guide to navigate what matters in the digital age and supports vendor selection.

Optionality is key

For software solutions that offer high technology and business model enablement, the report uses the term: “transformers”. It acknowledges that selecting a transformer solution is not about buying complex technology. It’s about buying the optionality to be sure that, however competition and markets evolve, your business will be able to successfully adapt and capitalize on change.

Today wealth managers may be operating in a market where customers are only demanding changes to delivery models. They may be satisfied if you just provide the same services as always, but over digital channels. But the experience from the Asian market shows that this won’t suffice for long-term competitiveness; younger demographics don’t just want digital channels, they want engaging experiences. They expect digital services to be personalized, mobile, interactive, social, seamless. They don’t expect to get standard offers, but to be introduced to customized products and services that improve their financial wellbeing. Inevitably, this means firms will need to go further than changing servicing models, they should change sourcing and operating models, too.

Ultimately, we are heading towards a much more ecosystem-based financial system. Firms, whatever role they play in the value chain, will sit within a wider network. Hence the game-changing capability that should be top of mind for every individual assessing new wealth management systems is orchestration; having a system that can handle and derive intelligence from the exponentially-growing network interactions; having a system that can pro-actively drive the digital disruption happening within financial distribution, as well as having a system that can unlock massive platform-related network effects.

Orchestration is barely discussed in most industry analyst reports, yet it is critical to success in the digital age. This is why we need new maps. And just don’t take my word for it. Just look to what is happening in Asia.