Article first appeared in The Swiss WealthTech Landscape Report 2022

The psychological barriers of taking regulated products via brands are finally down. Christine Schmid, Head of Strategy at additiv, reviews their recent consumer Embedded Finance needs survey to understand investment and savings service preferences.

In our overly-complex world, we continually seek simplicity and ease. Facilitated by digital innovation, consumer brands increasingly recognise this, diversifying their business and offering highly-contextualised financial experiences to become more central to our lives.

In financial services, this development started with payments 15 years ago, moved on to consumer-related lending, such as buy now pay later, and has now reached insurance and wealth services.

Many brands (often non-financial) now see a gap in their offering that they can fill to enhance their customer value propositions and grow client relevance while increasing revenues. A gap highlighted in our recent global consumer survey – Understanding the Embedded Finance Opportunity: Consumer Study 2022.

This summer, we reached out to over 3,500 consumers across the globe to understand their view of digital financial services, their interaction, and their appetite for a wide range of investment, savings and financial well-being-related tools and services. The results were surprising.

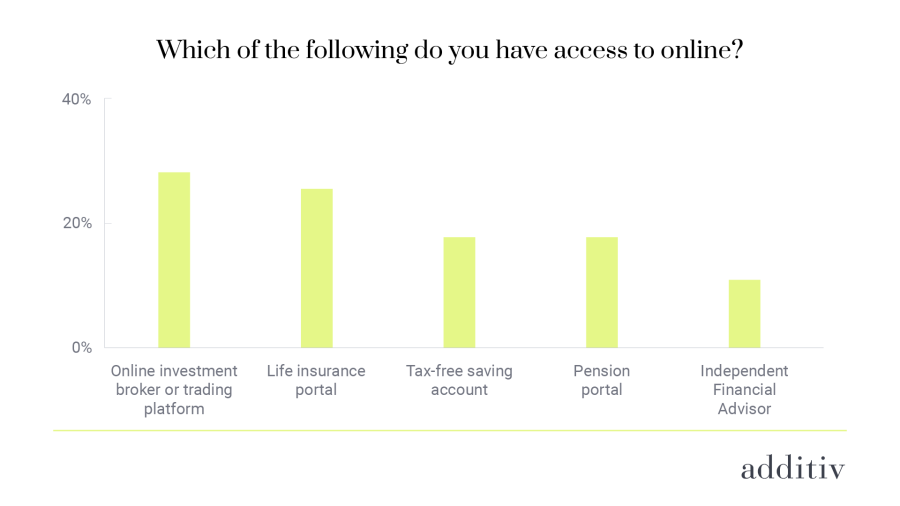

Most consumers are not using online investment and savings platforms

63% of the world’s population is online, according to Statista, with the number of people concerned about their financial future at an all-time high. Yet, our survey discovered that very few consumers regularly review and interact with those online financial services that could help address their current and future financial wellbeing (see Figure 1).

Figure 1: additiv survey – Understanding the Embedded Finance Opportunity: Consumer Study 2022

There may be several possible reasons for this low penetration, including a lack of awareness of wealth management-related products and limited, easy access through traditional channels. However, regardless of the reason, there is no doubt that if financial service providers strive to democratise wealth, these figures must increase dramatically – and availability will support this.

There may be several possible reasons for this low penetration, including a lack of awareness of wealth management-related products and limited, easy access through traditional channels. However, regardless of the reason, there is no doubt that if financial service providers strive to democratise wealth, these figures must increase dramatically – and availability will support this.

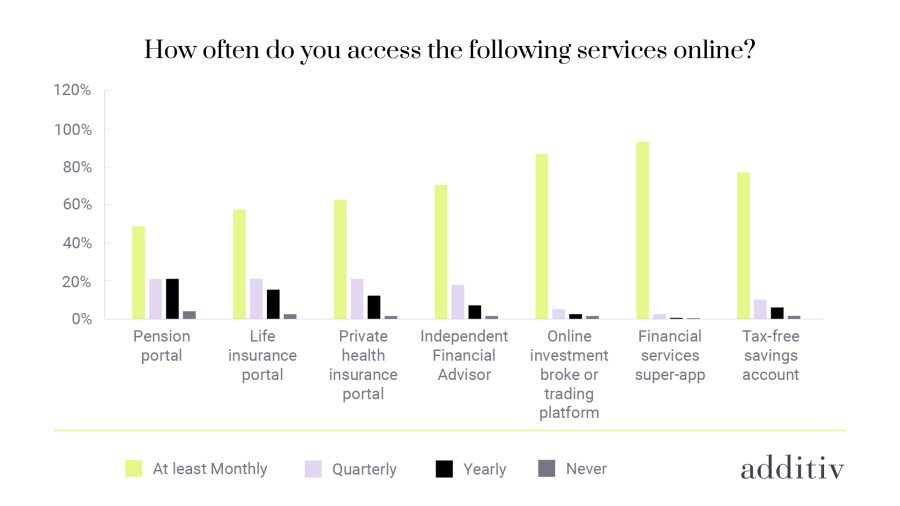

Consumers with financial platform access interact regularly and are engaged

Our survey demonstrated that consumers with access to online financial services tend to interact regularly (see Figure 2). This indicates that once these platforms have engaged their audience, developing a brand affinity should be easy, opening cross and upselling opportunities. Offering financial services when it matters to consumers, contextually relevant and embedded in natural client transactions, is, therefore, key to leveraging these opportunities.

Figure 2: additiv survey – Understanding the Embedded Finance Opportunity: Consumer Study 2022

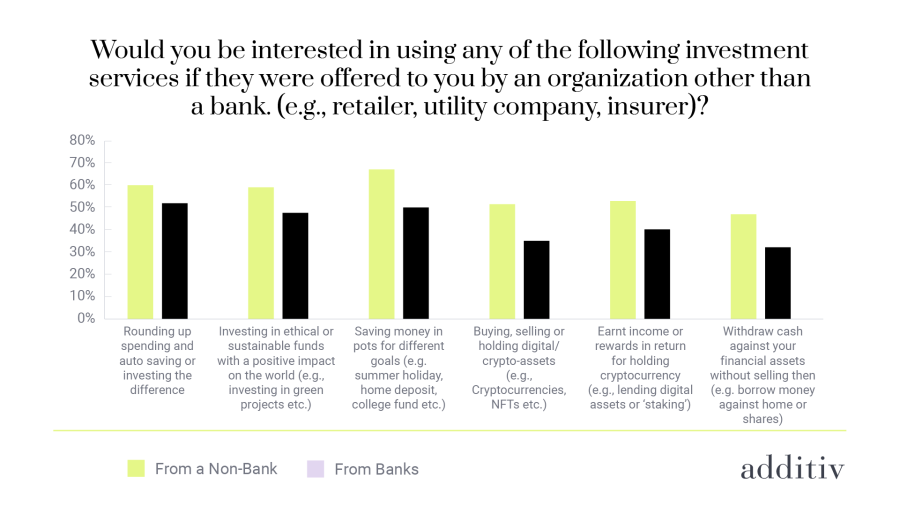

Consumers prefer embedded finance offerings via brands

Surprisingly, our survey shows that consumers are happy being offered relevant wealth services via organisations other than banks (see figure 3). They seem to prefer taking these from non-banks. For example, there was almost a 20% difference between wanting savings pot-related services to support goal saving from non-banks (68%) vs banks (50%).

Figure 3: additiv survey – Understanding the Embedded Finance Opportunity: Consumer Study 2022

So, the psychological barriers to taking regulated products via brands are finally down. And Banking-as-a-Service (BaaS) enables this physically, but how realistically (and effectively) can wealth providers offer their services through a consumer channel? And reversely, how can a brand (including banks and asset managers wanting to expand their proposition) offer these regulated products and other complimentary services? The answer is orchestrated finance.

The importance of orchestrated finance

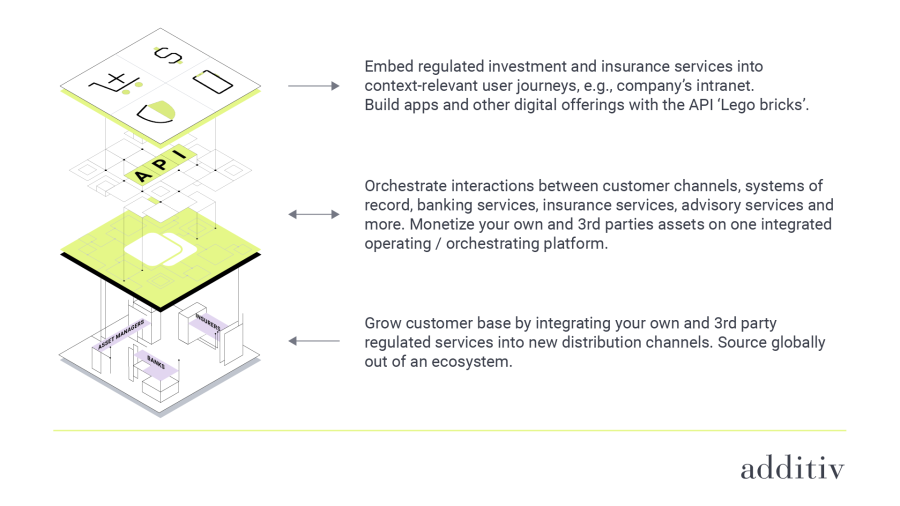

Orchestrated finance is a relatively new term, but the principle has been around for years and has not been applied effectively before. Generally, orchestration refers to automating the configuration, management, and interoperability of disparate systems, applications, and services to create a seamless, single experience for the user.

In terms of orchestrated finance, financial (often regulated) products and services are seamlessly combined and offered intelligently and contextualised to end consumers at their point of need. The current financial products are made available through BaaS, providing access to a wide range of tools, products, and services, sourced through an orchestrated finance model. These are accessed through an orchestrated finance platform. This platform is essentially the glue that enables the true value of BaaS on the supplier side and embedded finance on the demand side to be realised by both parties.

What is important about an orchestrated finance model is that it finally puts consumers first. Embedded finance has revolutionised how financial services are consumed, but historically ‘onesize- fits-all’ products have been offered regardless of meeting consumers’ individual needs. Orchestrated finance, however, empowers consumer brands and financial institutions to source financial services from an open ecosystem and arrange them in the way they want. This enables them to create financial experiences that are truly customer-oriented, comprehensive, seamless and highly contextualised.

From a business perspective, orchestrated finance gives embedding brands the freedom and flexibility they need to support their customers’ unmet needs. It also makes it easy to complement offerings and services for banks and insurance, which cover all or part of the value chain.

Orchestrated finance for the wealth industry

Our recent survey has confirmed that despite low levels of digital investment and savings platform penetration, those who interact, do so regularly. Add to this the fact that a high number of consumers are happy to purchase financial and investment services from any brand they have an affinity with, and the case for embedded wealth speaks for itself. But how big is the opportunity?

Back in 2020, the addressable market for embedded finance was estimated at over US$7 trillion, or roughly double the market value of the world’s top 30 banks today. Since this initial estimate (which focused on insurance, payments and lending), the opportunity for embedded wealth has also been recognised. In fact, we estimate the potential addressable market for these companies is over US$100billion in additional revenues globally over the next 10 years.

Most recently, the embedded wealth opportunity has been the focus of industry analyst, Celent, with its report: Wealth-as-a-Service, Part 1. In particular, the information reviewed the landscape and segmented the few providers identified as supporting this opportunity across the ecosystem.

Figure 4: additiv survey – Understanding the Embedded Finance Opportunity: Consumer Study 2022

The report recognised the importance of an orchestration model and identified additiv as the orchestrator connecting distribution partners (brands) and wealth providers.

More will undoubtedly follow. However, what will be crucial is for these platforms to adopt an orchestrated finance model. A model and platform that enhances end-to-end value propositions with seamless customer focused financial experience. But above all, one that supports what our survey illustrates is needed. One that puts people first, because putting people first is not the future of wealth management – it is the now.

Orchestrated finance empowers consumer brands and financial institutions to source financial services from an open ecosystem and arrange them in the way they want. This enables them to create financial experiences that are truly customer-oriented, comprehensive, seamless, and highly contextualised.