This article was first published in Private Banker International in May 2021.

The big buzzword in fintech at the moment is embedded finance. It refers to the concept whereby financial services, now digitized, can be distributed through any channel. Effectively, it is the next big shift in fintech disruption.

If the first phase of fintech was about not going to a bank, this phase is about not even going to a banking app. Instead, financial services just get consumed at the time of need and through the channel that is most convenient, like getting credit at the point of sale.

This phenomenon of embedded finance has been mostly associated to date with payments and lending, but it will become ubiquitous. In our last article for the PBI, we outlined some of the use cases for embedded wealth management. In this article, we want to get a bit more practical: taking a single use case and walking through it, from why it makes sense to how to do it. We have chosen financial health.

A reminder of the embedded finance opportunity

The reason that everyone gets so excited about embedded finance is that it promises to open up a much bigger addressable market for financial services. Up until now, financial services have not just been distributed predominantly by financial services companies, but they have also been product-based. By that, we mean that financial services came in defined forms which providers, not customers, conceived. Customers always had needs – or “jobs to be done” – such as getting funds to grow their business, but financial institutions offered pre-packaged products that customers had to understand and choose from, such as asset finance or overdrafts.

Embedded finance changes the paradigm. Firstly, as most people have realized, financial services production gets unbundled from distribution, so services can be distributed through other channels. But this is not especially new: your favorite retailer has been offering a credit card to you for years. The difference now is that services get unbundled both from the producer and from the product form, at the same time as they get married with context. So, today, if I want credit when I make a purchase, using a credit card isn’t the only choice. I have other options which are more immediate, more convenient and more personalized, such as paying by installments, which are embedded frictionlessly into my purchasing experience.

By making financial services available through contextualized use journeys at the time of need, pre-digital problems such as low self-discovery and high drop-off rates evaporate. Instead, demand equals supply.

Numbers about the impact vary, but most estimates suggest this could double or more the current size of the addressable market for payments and lending. We don’t see why this would be any different for wealth management.

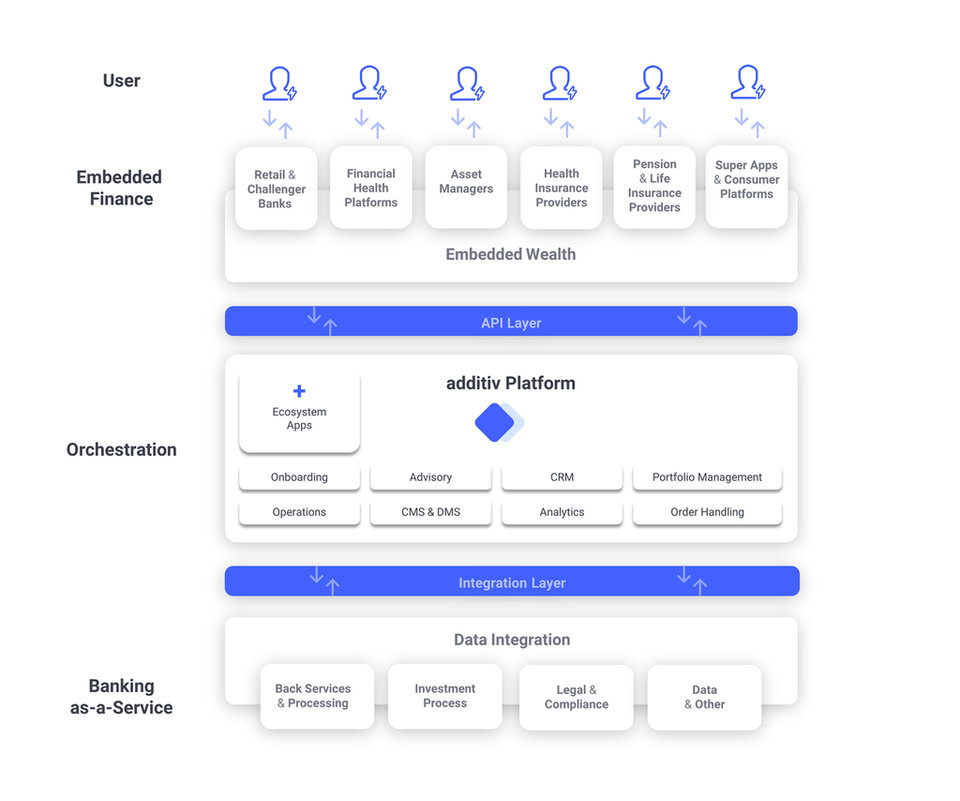

Embedded wealth: an end-to-end approach

Why financial health needs to be addressed

For wealth management, as the graphic above illustrates, there are many use cases for embedded wealth, of which financial health is just one. But it is an important one.

Today, the pillars of financial health are siloed. Occupational pensions are considered independently of personal pensions, which are considered independently of life insurance, which is considered independently of wealth management.

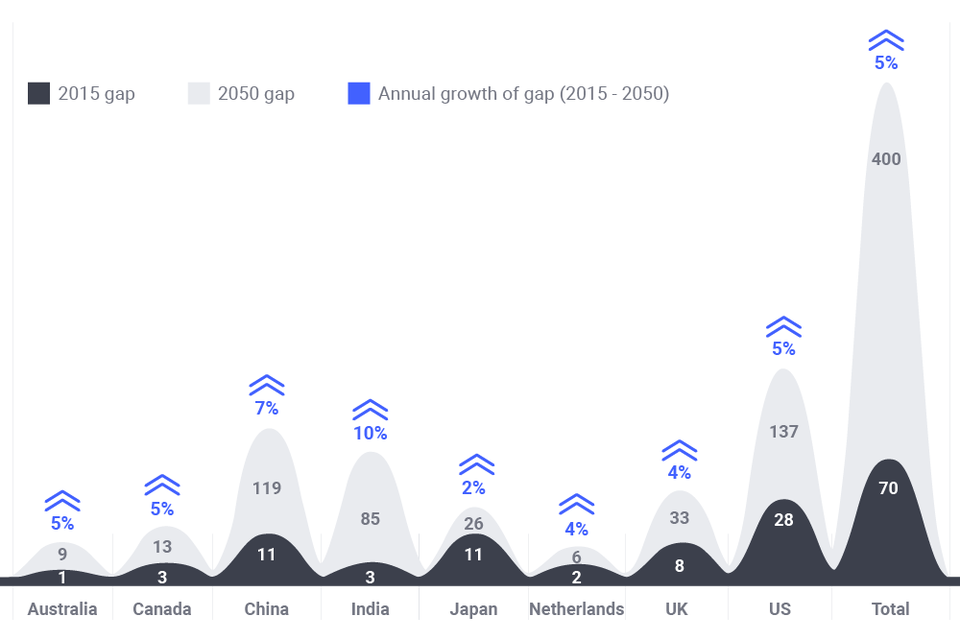

As well as creating headaches for the consumer, this fragmentation also leads to suboptimal outcomes at a time when global pension deficits are already ballooning. Owing to a combination of low interests, growing life expectancy and materially unchanged retirement ages, the World Economic Forum estimates that the global pension deficit is growing by a compound rate of 5% annually and will hit $400 trillion by 2040.

Global pension deficit by compound rate

How embedded wealth can help

Financial health service under-provision stems in part from this challenge of needs vs products. An individual wants to be financially secure in retirement. They are not necessarily looking for a discretionary portfolio mandate or an opt-out, self-select occupational pension or a life insurance policy. The range of different products and providers is perplexing and leads to, at best, silos and, at worst, inaction.

This is where embedded wealth comes in.

It enables wealth management services to be offered over an existing channel. That is, a consumer wouldn’t have to seek out a wealth manager/advisor or private banker where, in most cases, no reference point exists for doing so.

It becomes proactive. Rather than a consumer first needing to figure out that they are falling short of a sustainable retirement and then having to find and select a product that could help. The need would have been uncovered and relevant options presented within an existing user journey.

It won’t necessarily be limited in form. It’s not inconceivable to think that only a minority of people have access to great financial health advice today, but even that financial advice is still likely to be limited by the products on offer. By starting with customer context, embedded wealth management gets closer to individual needs. For example, most products today focus on accumulation of assets for retirements, while the systematic and sustainable decumulation of assets is equally important to leading a comfortable retirement.

In terms of the existing channels into which financial health could be embedded, insurance (both health and life) are prime candidates since both have the context and the pretext to be able to offer wealth services. Who said bancassurance was dead?

White-labeling vs embedded wealth management

Embedded finance seems a no-brainer. If embedding wealth management gives insurers the chance to significantly increase existing customer lifetime value and reduce churn, it will transform their unit economics and it is self-evident that they would want to do so.

The question is more about how best to go about embedding wealth management into their offering. One option might be to build or buy a wealth manager. This seems a pretty extreme case. A more viable option could be to strike a partnership with a wealth manager, offering this partner the option of growing its volumes with minimal acquisition.

However, the problem with forming partnerships for embedded finance is the same problem as insurers had in the past with white-labelling. The integration takes a long time, which inhibits their ability to capitalize on a fast-growing and nascent market. Second, the integration is likely to be tightly coupled, which creates high dependency and high switching costs. Thirdly, it lacks flexibility both around the range of products and the presentation of these products.

Orchestration platforms

There is a better option. There is now a possibility to embed wealth management services straight out-of-the-box using orchestration platforms like additiv DFS®.

A modern embedded finance platform has several advantages over a DIY approach:

- It is a plug-and-play option, easy to integrate, quick to launch.

- There is the flexibility not just to brand the services, but to extend them and embed them natively into user journeys.

- It has the intelligence to understand context and make smart recommendations based upon multiple datasets.

- It is pre-integrated with all other essential services, such as custodians, execution platforms and market data, that make it a one-stop-shop.

- It can orchestrate between many different other parties and systems. This extends the services on offer. It also ensures that the insurer won’t face restrictions if it wants to offer services across different jurisdictions.

- It can scale infinitely without affecting customer fulfilment, since it abstracts away from the underlying production and record-keeping systems.

The embedded wealth stack

additiv has been busy putting together the right partnerships – the stack – to ensure that it can meet the diverse requirements of regulated, context-driven wealth management across the globe – all through a set of standard APIs.

Recent partnerships we’ve announced include Kidbrooke, which provides financial and pension planning solutions, and Bricknode, which provides a cloud-based core banking system.

If your institution is considering embedding wealth management into your offering, additiv would be a great partner.

If your institution is not considering embedding wealth management services into your offering, why not?

—————————————————————–

Contact details

Additiv AG

Riedtlistrasse 27

8006 Zürich

Switzerland

+41 44 405 60 70

community@additiv.com