- This article originally appeared in the MEA Finance magazine, March 2024 edition, page 34

The financial services industry finds itself undergoing a transformation driven by the rapid evolution of technology, especially through an open architecture approach. The traditional value chain, characterized by the tight integration between manufacturing and distribution of financial service products under a single entity, is being reimagined. This revolution, driven by the emergence of embedded finance is a transformative force, reshaping how customers interact with financial services. This paradigm shift is not just a mere trend but a profound evolution, redefining the value chain of customer experience and reimagining the role of financial institutions.

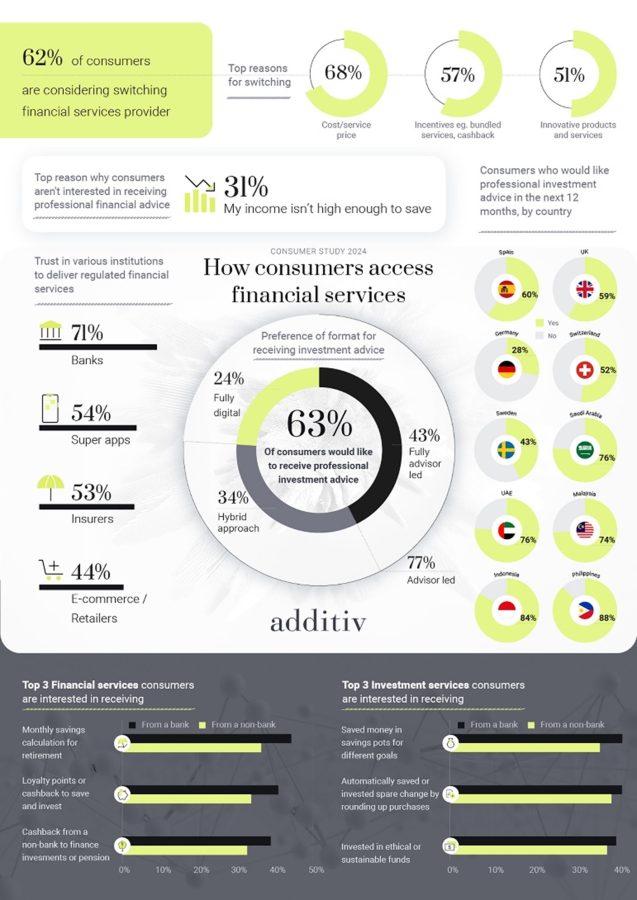

The consumers’ voice

Embedded finance disrupts the old paradigm, weaving financial services into the fabric of everyday digital platforms and experiences. The shift at hand goes beyond mere incremental innovation; it establishes a new bedrock for the industry, restructuring the essence of how services are offered and consumed – unbundled, re-bundled and embedded in new and non-traditional channels. They are more accessible to new customers and can be more tailored to specific consumer needs. At the heart of this revolution is the consumer—a consumer who, according to our extensive study[1] capturing the views and behaviours of 4,500 individuals across 10 countries around online financial services—is unequivocally vocal about the desire for cost-effective, trustworthy, and engaging financial solutions.

The data speaks volumes: only 4 in 10 consumers have received professional investment advice in the past 12 months, while 69% of those that didn’t receive expressing a desire to receive investment advice going forward. Services like wealth management and investment advice have traditionally been reserved for the very few. Technology can make these critical financial services more accessible and inclusive, either fully digitally or through a hybrid approach.

Trust is key to the relationship between consumers and providers of financial services. As we increasingly see financial services offered by non-financial brands, it is natural to ask whether consumers trust these new entrants with their money. Traditionally, banks have had high levels of trust. Our survey confirmed that this is still the case. However, non-financial providers are increasingly trusted to deliver financial and investment services. On average, one in two consumers trust super-apps, e-commerce platforms, retailers, telecoms and utilities providers to be their provider of financial services, suggesting that the playing field for embedded financial services is wide open for many non-financial brands.

Furthermore, nearly two thirds of consumers would consider switching their existing financial service providers, especially if the incentives – mainly around costs – align with their needs, painting a narrative of dissatisfaction with the status quo and a call for a more equitable financial ecosystem.

Zooming in on the Middle East, as affluence and digital literacy is rising, there remains a notable gap in the provision of high-quality financial services tailored to the unique needs of the region’s consumers, particularly in wealth management and investment services. The 1,000 consumers surveyed across the UAE and Saudi Arabia reveal a significant demand for professional financial or investment advice. Despite 49% of respondents not having received such advice in the past twelve months, a striking 76% expressed a desire for it in the coming year. Preferences for the delivery of this advice are evenly divided, with consumers showing equal interest in advisor-led models and hybrid models that blend digital platforms with advisor interaction. In line with the global trends. the Middle East consumers show growing trust in taking financial services from non-financial institutions.

The survey’s insights are a testament to the evolving landscape. Costs, trust, and distribution channels play a critical role in the future of the financial services value chain. These factors reinforce the need for a transparent, customer-centric approach—a philosophy that guides the integration of financial services around rich ecosystems, ensuring mobility and choice are at the forefront of financial services.

Finance-as-a-Service: the new ecosystem of value

The democratization of financial services requires an architecture that champions the right mix of products, embedded seamlessly at the point of need. It’s about orchestrating ecosystems that foster competition, driving down costs, and broadening access—a feat achievable through highly efficient and scalable business models that circumvent traditional barriers to service provision.

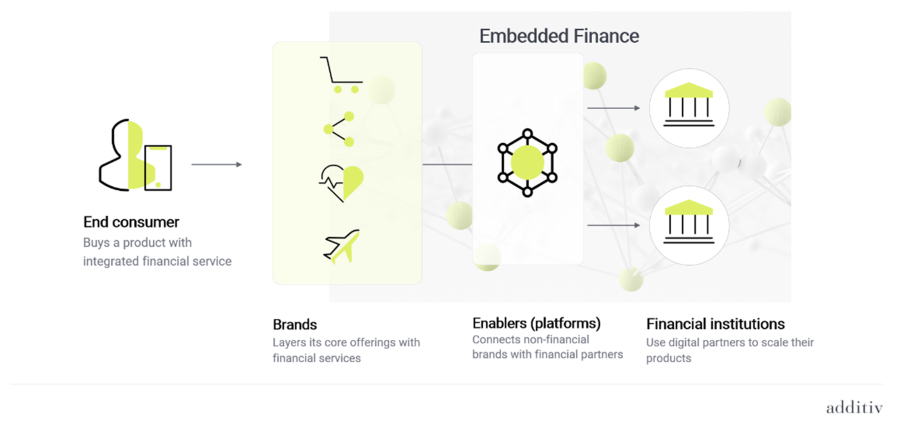

Finance-as-a-Service (FaaS) is the infrastructure that underpins embedded finance: the seamless integration of financial service capabilities into diverse platforms, whether they be financial firms expanding their offerings or non-financial firms venturing into financial services. The agility of FaaS, powered by APIs, cloud, and digital technologies, enables a repackaging of financial services — such as banking, wealth management, credit and insurance — that resonates with the modern consumer’s expectations.

Embedded finance is not merely a conduit for delivering financial services; it’s a fulcrum for inclusion. It eradicates the traditional costs of customer acquisition and galvanizes take-up rates by embedding relevant services within existing customer interactions. It’s a narrative of relevance, of services tailored to fit the uniqueness of each consumer’s life. It’s not about digitizing fragments of the customer experience but redefining the entire model. For incumbent institutions, it heralds new avenues of distribution, sourcing, and operation—delivering not just services but experiences that resonate across demographics.

A paradigm of retail innovation transcending into financial services: Coop Finance+

It is worth reflecting upon the approach of Coop[2], Switzerland’s largest retailer, to provide comprehensive financial services seamlessly to their customers, via its financial super app Coop Finance+, which is fully integrated with the Coop brand and other digital channels.

Consumer brands may be well-placed to provide financial services, but they need regulated providers to deliver those services, plus a reliable technology partner to connect them. Leveraging additiv’s orchestration platform for embedded finance, Coop was able to integrate and manage various financial services and banking-as-a-service (BaaS) partners, into a seamless end-to-end customer experience. Coop Finance+ significantly enhances the ease and reach of financial services. By consolidating high-quality banking, investment and retirement options into a single app, it simplifies what is often a complex landscape, making these services more accessible and affordable for a broader audience.

Coop’s strategic partnerships exemplify the potential to leverage retail footprints for financial service distribution, marrying convenience with financial empowerment.

Embracing the Future: consumer-centric embedded finance

In the Middle East, especially in UAE and KSA, we see large non-banking institutions such as e&, Du, STC, Careem etc, making strategic decisions to foray into the financial services industry. The capability for non-banking institutions to satisfy unmet financial needs stems from technology’s empowering role, enhancing their customer value propositions. This approach is particularly effective due to the extensive customer base that these institutions have, which is characterized by high loyalty and engagement levels, presenting a ripe opportunity to expand their offerings and fulfil these financial gaps.

Every successful customer journey involves a financial transaction. Combined with consumer insights from various parts of the value chain, non-banking financial institutions can contextualize and personalize financial service propositions and drive new revenue pools.

We at additiv see a landscape where financial services are not bound by institutional walls but are orchestrated across a tapestry of providers, delivering unparalleled choice and transparency. It’s a world where the financial value chain is not a monolith, but a network of diverse opportunities, each offering unique benefits to enhance the consumer experience. As we envision the future, the imperatives are clear. Financial services must be liberated from their traditional confines, embedded within the broader narrative of consumers’ lives, and delivered with an unwavering commitment to accessibility, affordability, and relevance.

This kind of collaboration brings benefits on all sides. For non-financial brands, there is the opportunity to provide new value-added services for their customers. Meanwhile, established financial providers can tap into new markets, new customer segments and new, more efficient distribution channels, accessing much more holistic information about consumer activities and preferences.

In the Middle East we are seeing an emerging trend of the financial services industry heading in this direction. Both non-banking institutions and financial services providers are experimenting, iterating and investing in this space along with regulatory support on open-banking and open-finance being established and further enhanced.

[1] Embedded Finance Consumer Study 2024: How consumers access financial services, by additiv and Ipsos – https://www.additiv.com/insights/embeddedfinance2024/

[2] Coop Finance+ Case Study – https://www.additiv.com/coop/