This article first appeared in The Wealth Mosaic’s ‘THE SWISS WEALTHTECH LANDSCAPE REPORT 2021’ (December 2021)

An embedded finance approach can bring together pension contributions, life insurance services and relevant asset management, say Silvan Schriber, Head Corporate Development, and Thomas Schornstein, General Manager Switzerland at additiv.

The popular perception of Switzerland as the affluent Alpine home of the mega-wealthy is, like any stereotype, partly based on reality. The medium income here, of CHF 50 000 per annum, is one of the highest in the world. But with high income comes high cost of living. In 2021, The Economist’s Big Mac Index showed Switzerland to be the most expensive place on earth to live. And, as result, the Swiss population is not without financial challenges.

Take pensions, as an example. This is a global problem where, even a rich nation like Switzerland is not exempt. Over the past four decades, employers across the world have steadily reduced the generosity and pervasiveness of their employee pension provisions, moving the responsibility to individuals. This has coincided with a growing life expectancy and falling pension asset yields, creating a structural and growing deficit. While the Swiss challenges are tiny in the context of what the World Economic Forum believes will be a USD400 trillion gap worldwide by 2050, there are still challenges to face.

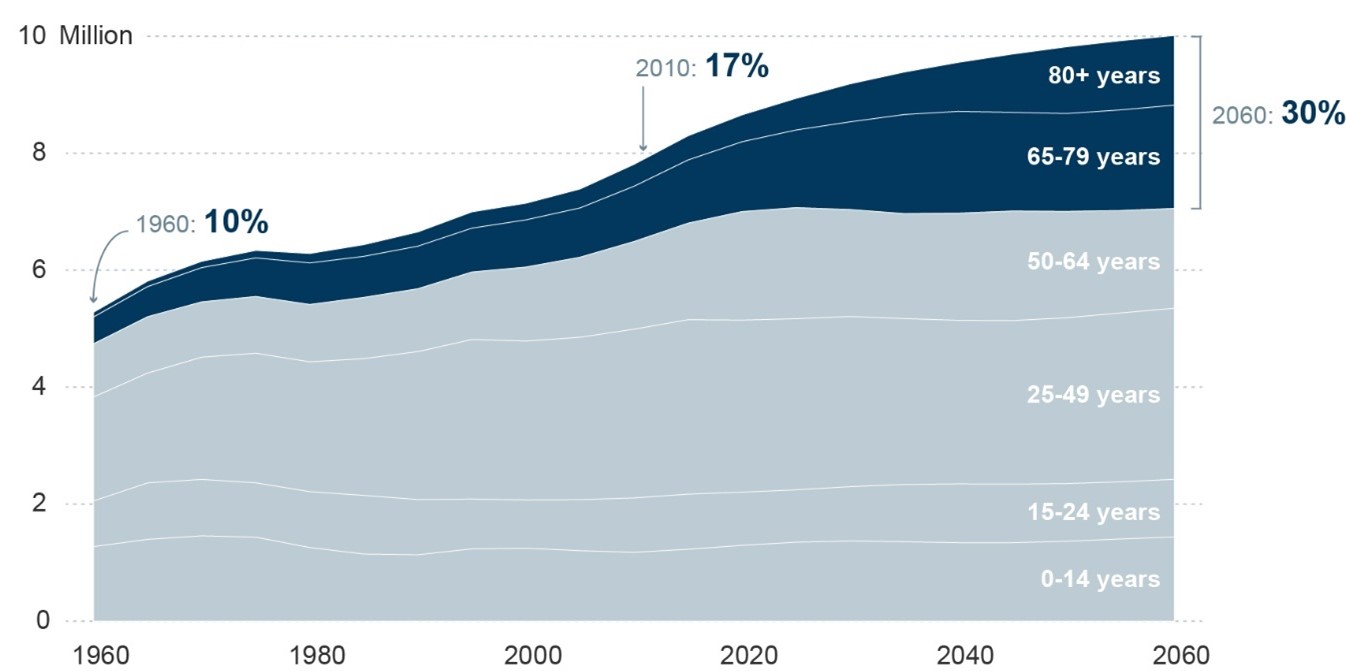

Population ageing will intensity in Switzerland

Figure 1: Swiss population by age group

Source: OECD Economic Surveys – Switzerland 2019

Statistics show that retiring baby boomers and rising life expectancy will lift the share of the population aged 65 or over to almost 30% by the 2050s, a faster rate of ageing than most OECD countries. This means that in Switzerland, over a third of the population faces a pension gap upon retirement age. Simply put, a pension gap arises when the assets set aside for retirement do not allow the individual concerned to maintain their existing quality of life.

Switzerland has a three-tier pension system and the first two pillars are largely governed by law and hence most (working) people are well-covered. However, the first two pillars are only ever meant to cover up to 60% of final income and, therefore, where an individual has gaps in the first or second pillar due to lower percentage of work or has not made sufficient third-pillar contributions, a gap can arise – often in the case of low work pensum or prolonged maternity, paternity leave.

Not setting aside enough money into the third pillar scheme may be a function of many other factors. For some, it is simply a question of means. According to the Federal Statistical Office, nearly 9% of Swiss people live below the poverty line, including some 4.2% of working adults. Nearly 21% would not be able to manage an unexpected expense of CHF 2500 per month, and one in eight people (12%) in the report highlighted that they had trouble making ends meet. But for most, the reasons normally owe to financial education (knowing the importance, as well as the tax advantages, of providing for retirement) and accessibility (being able easily and periodically to access the tools to make these extra pension contributions).

The Swiss citizen, as in most places, is not helped by a system that is fragmented and disjointed. The occupational pension (the first two pillars) is considered independently of the personal pension (the third pillar) which is then considered independently of the rest of a person’s asset and wealth management. On top of that, management of life risks, such as disability, death or unemployment, are all considered independently, too.

At additiv, we see an opportunity to do things differently. Our view is that financial services need to become more embedded into existing customer channels and user journeys. In general, this will improve accessibility for consumers and improve conversion for financial services providers, a win-win situation. For pension and protection specifically, doing so would be a game-changer.

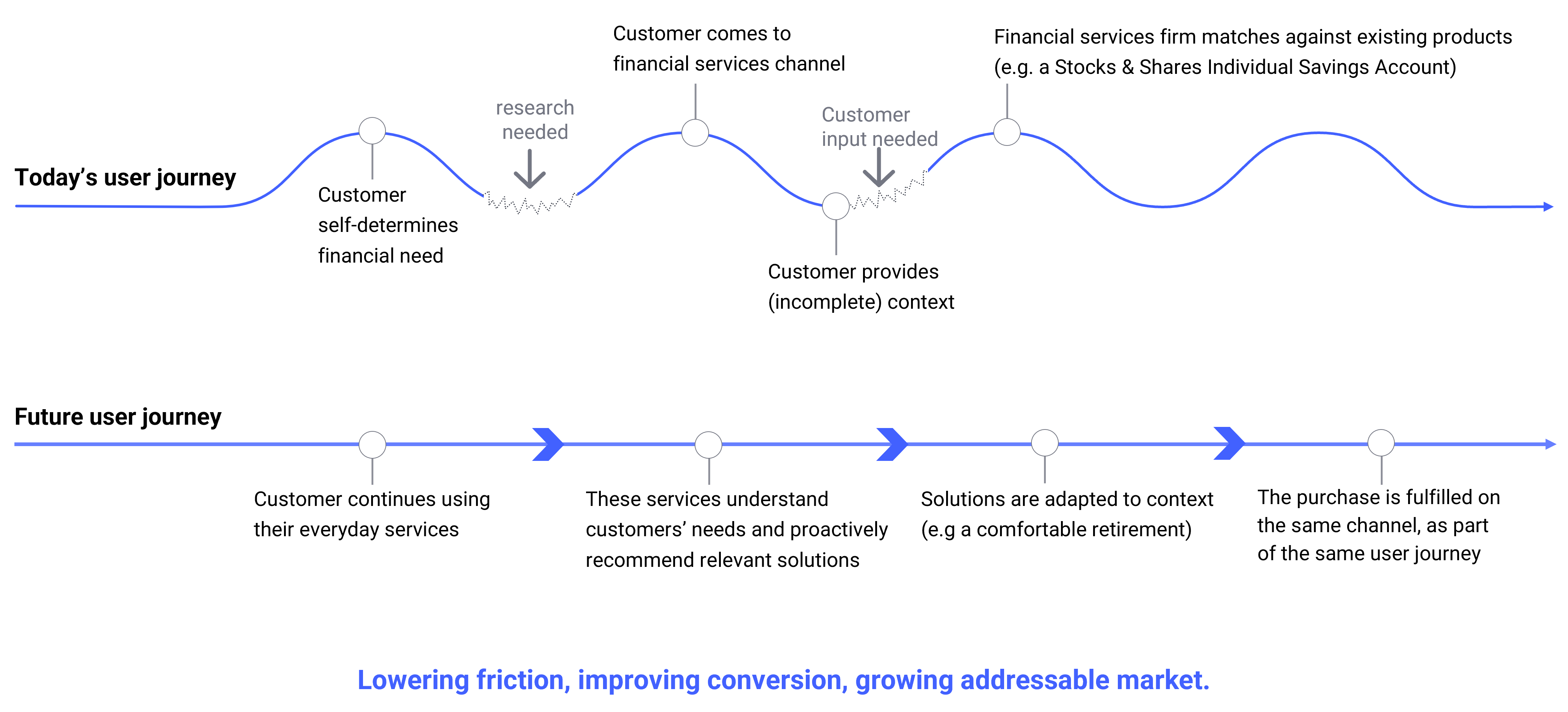

From selling products to addressing customer needs

Figure 2: Finance – from selling products to addressing customer needs

Source: Embedded wealth management: a $100 billion market opportunity hiding in plain sight

There is too much unnecessary friction today. It’s not difficult to see how separate products and providers are a large part of the problem when it comes to the pension and protection gap in Switzerland and elsewhere. If every stage of the process involves research about, and shopping around for, a product and then on-boarding with a different provider, this places a great burden on the consumer. Furthermore, dealing with off-the-shelf products in the first place hampers self-discovery. Consumers are not looking for products, but solutions for their needs (their jobs-to-be-done). As an example, they are not looking for incapacity insurance, but to know that they will have enough money in case of unforeseen circumstances.

Pension and protection coverage could and should be so much simpler.

First of all, pension contributions, life insurance services, and relevant asset management should be brought together. This could be done by the existing providers who could bridge the existing silos. The route to doing so would be embedded finance, partnering with Banking-as-a-Service (BaaS) platforms who could allow them to offer these services, embedded directly into their offering, without having to provide the services themselves. For instance, a pension provider could easily augment their offering, providing a gateway to relevant insurance as well as asset management services. The same would be true for asset managers or insurers. But, other companies, not necessarily directly involved in the provision of pension and protection, could do the same, especially those with highly frequent customer touch-points, cash back solutions such as online retailers.

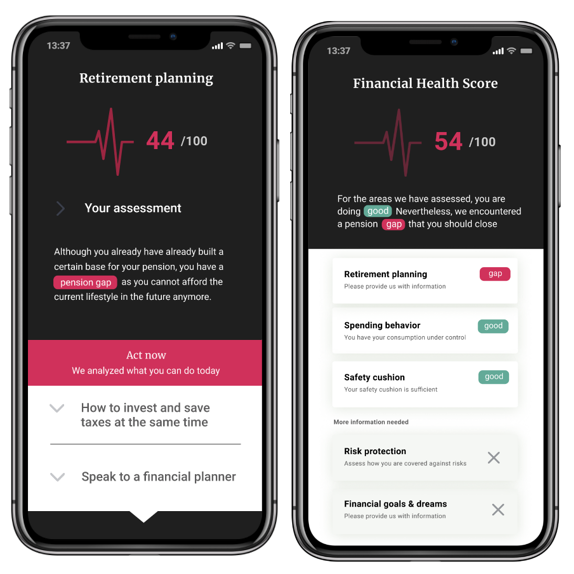

Figure 3: A human-centered approach to improve a client’s financial health

Source: additiv

The second way to make pension and protection simpler and more accessible is to add a wrapper of engagement and education around the services, helping to detach form from function to make the steps more intuitive and clearly explaining the outcomes. In effect, through thoughtful user experience, such as simulations, consumers can easily understand the risks they face, but also easily navigate the informed path to mitigating them – whether the underlying issue is a pension gap, inadequate insurance coverage or family coverage, or too conservative investment allocation.

Lastly, there is an opportunity to turn one-off events into continuous flows. In Switzerland, everyone has a tax-free personal pension allowance of almost CHF 7,000 a year. Paying this as a lump-sum can be daunting plus it is easy to forget to do so. The same is true of annual insurance premiums. All of this is easily calculated and managed through an app, but it makes sense to turn these payments into monthly subscriptions debited directly from the individual’s bank account or salary.

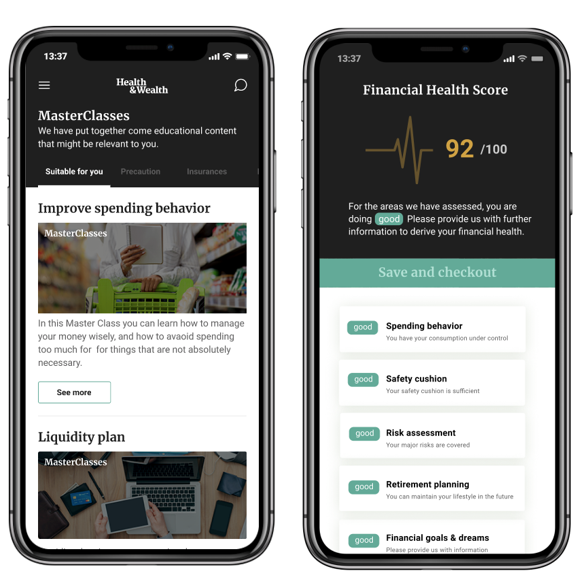

Figure 4: Guiding and incentivizing clients to a higher financial health score.

Source: additiv

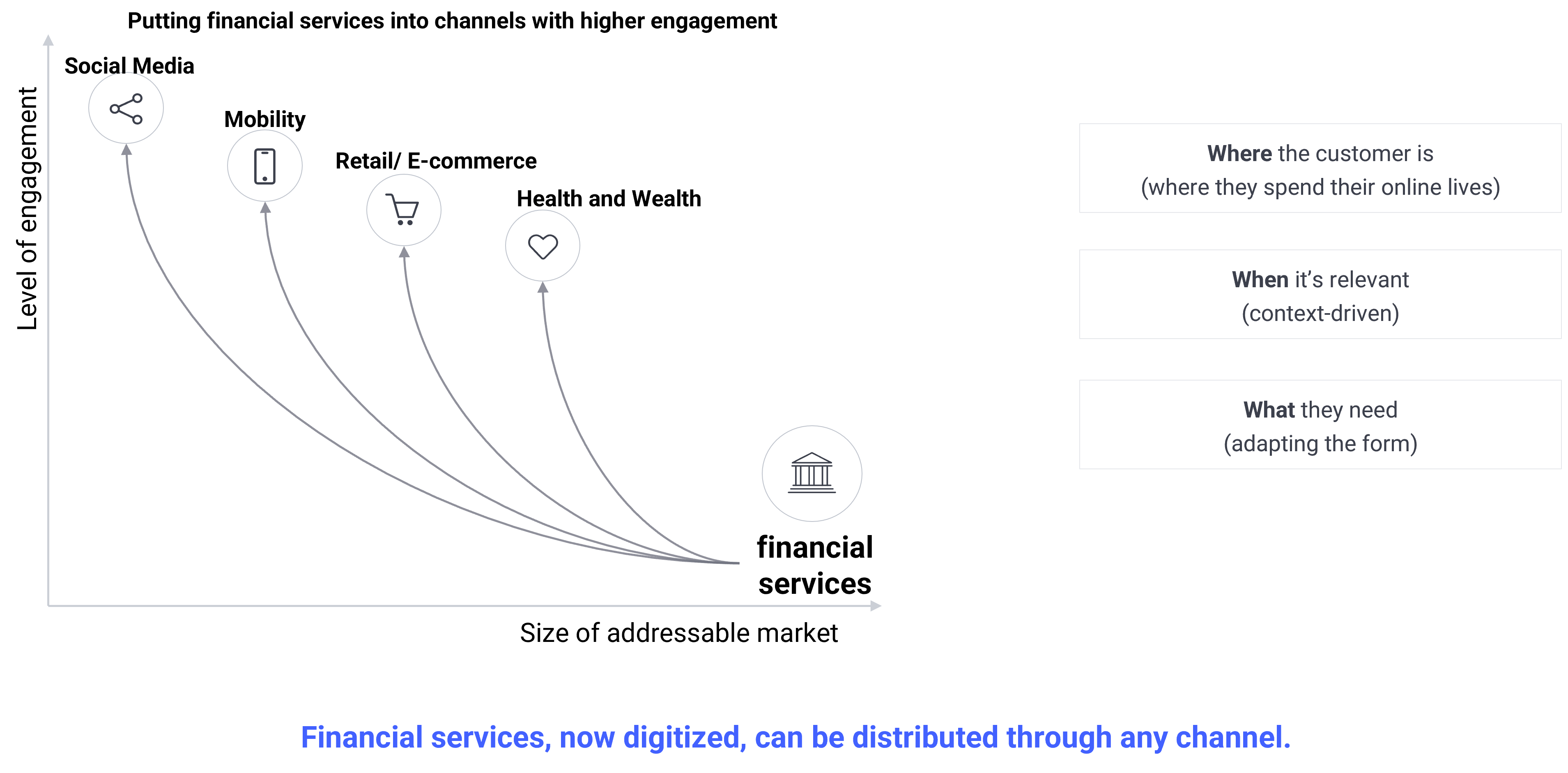

Embedded finance introduces new possibilities, which additiv can help your business to capitalize on. It is true that digitizing financial services allows these services to be consumed through mobile devices. But it need not and should not stop there. The true benefits of digitization lie in making financial services more discoverable, more accessible and more personalized – embedded in a context relevant user journey. In this regard, embedded finance is a paradigm shift.

Figure 5: Putting financial services into channels with higher engagement

For the first time, consumers can be offered financial services that are tailored to their context, delivered when and where they need them, and adapted to their needs rather than in a pre-determined format.

Embedded finance will help solve chronic and seemingly intractable problems of financial services under-provision, including the pension and protection gap in Switzerland. To discuss how additiv is helping and can enable your business to embed (additional) financial services, see our latest report and please get in touch.