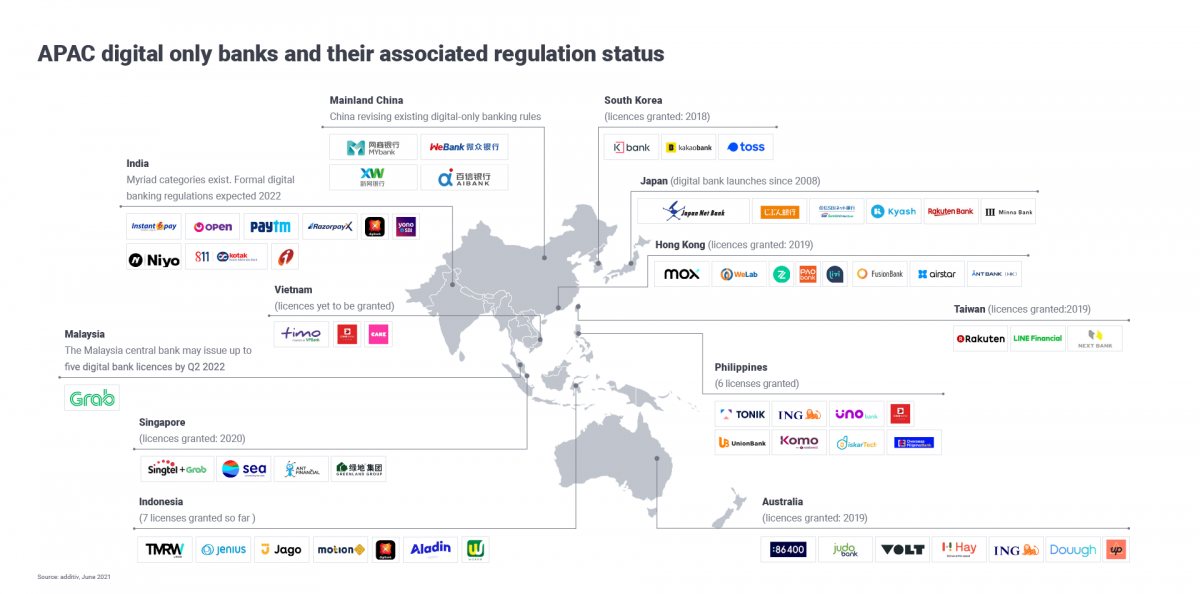

Digital banking has taken off in APAC. There are 20% of the digital banks worldwide in the region and Indonesia is already home to seven licensed digital banks, with more awaiting licenses. This is no surprise as the country’s large, young and relatively unbanked population offers significant growth potential to the financial services industry. Potential that includes the provision of wealth management services.

Source: additiv

In 2021, Indonesia’s digital banking sector received a boost from new rules[1] allowing (almost) full foreign ownership of local banking service providers. This move reduces red tape for new services and spurs growth in the country’s emerging digital banking industry. So, what does this mean for the country’s fast developing wealth management industry?

A changing population means changing needs

As Indonesia’s GDP continues to rise, the high-end of the mass market is emerging as a new segment with particular needs. Known as mass affluent, these individuals are often classified as professionals, business owners or senior management in a company with over 15 years experience. With an average monthly income of IDR7-15million (USD490-1050), this audience is expected to increase to 21% of the population by 2030 [2]and usually has an appetite to grow money and invest. The mass affluent class has markedly different investment preferences (eg. sustainable investments) and investment styles (eg. being more actively involved in investment decisions).

In addition, millennials and young investors in Indonesia are the biggest group of investors in local equities. Data from the Indonesia Central Securities Depository (KSEI) states that young investors (aged 40 years and under) make up 78.9% of the number of stock investors in the country. As of August 2021, there is a 99% increase (year-on-year) dominated by those who are under-30 years old.

The mass-affluent class and young investors, profile is similar. They share investment channel preferences, favouring mobile apps over branches, and receiving instant advice, news, and insights through their devices.

Thus, they are ripe for digital wealth management services and digital banks are well suited to support this.

Millennial and Generation-Z as the Driver of the Domestic Retail Investor Rising (2016-August 2021)

Source: Custodian Central (KSEI)

Digital supports mass affluent wealth service provision

One reason why digital banks offer such opportunity for wealth service provision is because with state-of-the-art digital wealth management platforms, they can scale quickly and offer high-margin services at significantly lower marginal costs.

In addition, the recent pandemic has forced digital robo-advisory business models across the globe to be refined. These are now becoming increasingly popular with both high-net worth individuals and the mass affluent. This is because, notwithstanding the draw of a simple, low fee service, there is still a significant cost of client acquisition in reaching attention-poor consumers and getting them to invest for the first time (or change their investment behaviour).

In fact, the cost of client acquisition through robo-advisory channels is significantly less than for a traditional investment manager, although the amounts invested and lifetime value is also usually significantly lower through this channel.

However, one important factor to support a wealth management customer is ensuring ongoing engagement. Wealth management can be a paradox, the more assets one accumulates, the more detached one becomes from managing it. Market information, asymmetric risks, diversification options etc. can all be overwhelming, without the right support; te customer disengages and transfers decision-making to a trusted (traditional) advisor. A hybrid model (a mix of self-service and advisor-assisted channels) overcomes this possible issue long term. Additionally, these digital services can add additional value by also guiding and, in some cases, educating this on the intricacies of investment.

So digital is an enabler of investment for the mass affluent segment, but where is the benefit to digital banks?

Wealth management supports digital banks

One of the biggest challenges faced by digital banks is the high cost of customer acquisition, estimated to be as high as $1,500.

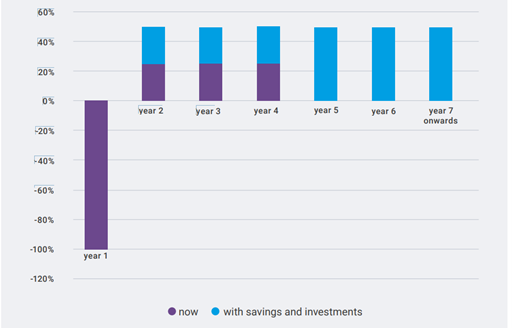

Customer lifetime value: net margin contribution per new customer over time

Source: aperture 2021

This high customer acquisition cost (CAC) is compounded by digital banks offering a limited set of products. This makes it hard to generate a high lifetime value to compensate for the high CAC. Worse, it puts customers at risk as they become more affluent and their needs become more

complex. With this in mind, focusing on customer acquisition alone isn’t sufficient for digital banks.

The alternative is for digital banks to grow with their customers, allowing them to grow share of wallet without the additional cost of sale; a much higher margin opportunity. To do so means retaining customers and expanding the service footprint when customers progress from saving to investing.

These customers usually start by setting up accounts for saving and spending etc. for all their banking needs. This benefit, coupled with better rates, easy transfers, and more visibility over expenses, is a powerful incentive. In reaching mass affluent consumer segments, digital banks can use this advantage to digitally establish customer standards.

We estimate that offering investment products doubles lifetime value within the second year of acquiring a new customer. However, digital banks can’t all easily launch self-serve investment services, they may lack resources and infrastructure, translating to lost opportunities to build customer loyalty, expand their portfolio, and generate long-term revenue.

Wealth service efficiency through an embedded finance model

The best way for a digital bank to quickly, easily and efficiently offer wealth services is to aggregate third-party wealth services into their platform. This is often referred to as ‘embedded wealth’. In the last 12 months digital e-commerce platforms and super apps like Tokopedia, Traveloka and Bukalapak have launched digital and embedded wealth services to capture the needs of this growing market segment, forcing traditional banks to play catch-up. My colleague recently co-wrote a paper (Embedded wealth in APAC: How to access a $32billion opportunity), where he explores the full market need and opportunity embedded wealth presents in more depth.

At additiv, we believe that with digital banks recent backing by Indonesian regulators, consumers decreasing concerns when depositing money, and easy access to new investments funds through digital tools, digital bank offering wealth management services will become the norm from 2022 onwards, all made possible by embedded wealth.

[1] https://asia.nikkei.com/Business/Finance/Indonesia-s-digital-banking-sector-receives-boost-from-new-rules

[2] Boston Consulting Group (BCG)