addWealth by additiv

Deliver innovative wealth management value propositions such as goal-oriented investments, retirement, and pension planning, personalized discretionary portfolio management and investment advisory solutions.

Seamlessly manage the full lifecycle of wealth management on a single platform, from prospecting and onboarding to financial planning, portfolio and risk management, and ongoing client servicing.

Combine your own services with those of regulated service providers fully integrated into the platform, allowing for fast time-to-market and rich, ever-expanding offerings.

Equip advisors and portfolio managers with an extensive array of service and productivity tools, enhancing personal relationship and advice through all channels.

Provide your end-clients with intuitive tools for managing their highly personalized investment portfolios, either independently or alongside their advisors.

Unparalleled impact

Our platform seamlessly integrates best-in-class technology, regulated third-party financial services, legal and operating frameworks, enabling any distributor to efficiently and effectively provide exceptional, personalized client experiences at scale under their brand.

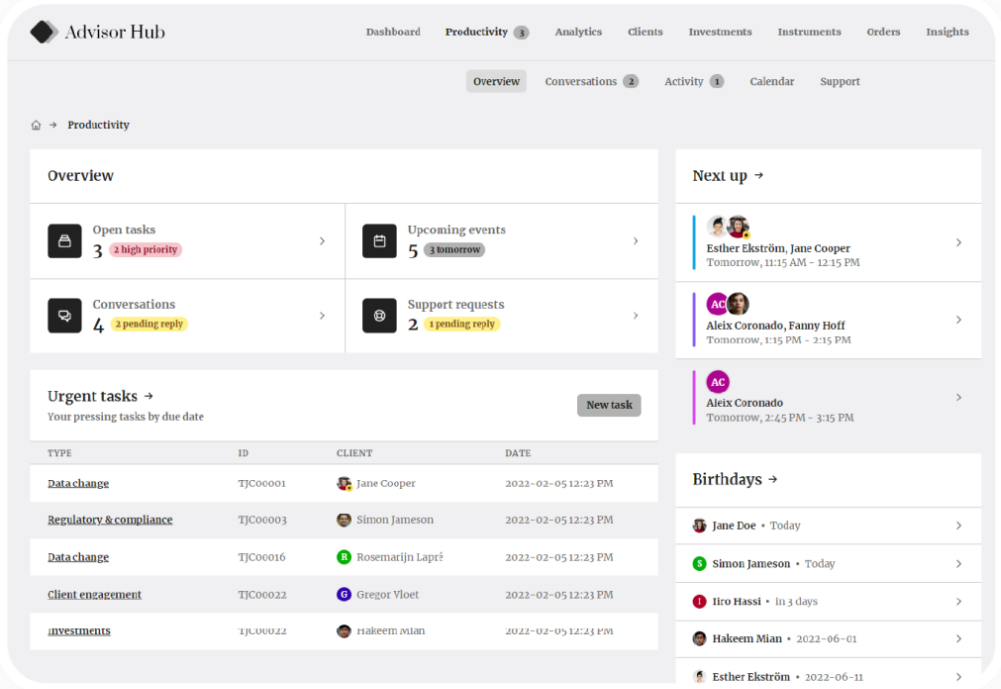

Empower advisors to deliver an exceptional service

Advisory productivity

A multi-function advisor hub for smooth wealth management operations which can seamlessly be embedded into existing portals fully compliantly.

Omnichannel servicing

Advisors are empowered to offer in-person and remote client conversations such as proposals, optimizations and simulations through a multitude of channels, in real-time.

AI-Copilot

AI powered communication technology of our advisor copilot enables advisors to comprehensively and compliantly respond to client queries and provide data-driven, informed decisions.

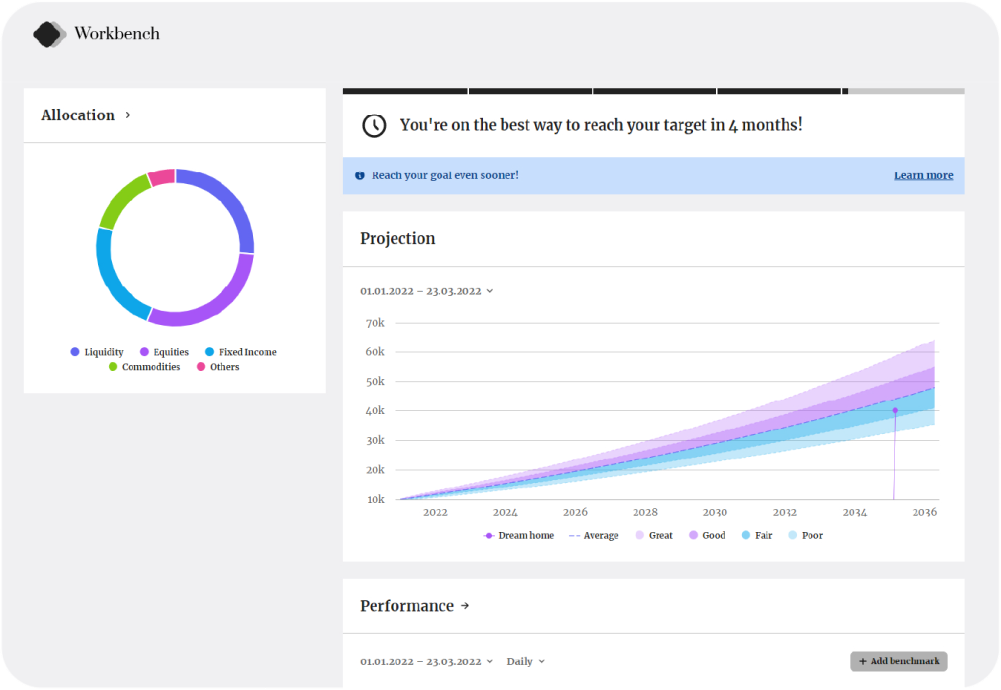

Build tailored portfolios at scale

Investment products, optimized for risk, lifestyle and goals

Ability to create truly personalized, yet compliant and risk-centric investment products according to every client's lifestyle, beliefs, and life stage.

Automated portfolio construction

Our wealth roboadvisor solution reduces the cost of offering personalized investment advice matching investors’ risk profiles and financial aspirations.

Rule based portfolio health check

Regular monitoring of all portfolios against pre-set constraints and alerting of all relevant parties. Option to include automatic remediation of rule breach and/or creating an investment proposal. Full transparency on constraint breach and real-time calculation of all risk metrics and KPIs.

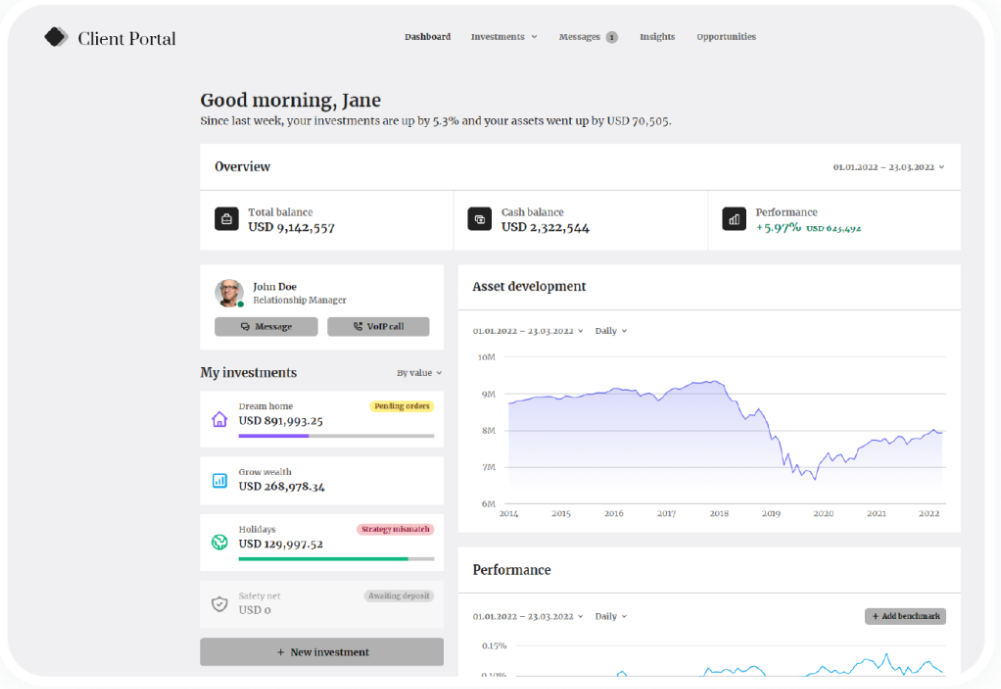

Engage with your customers

Outstanding customer experience

Provide your customers with rich, contextualized information in an intuitive way. Full omnichannel and AI capabilities to stay engaged and connected to your customers.

Comprehensive self-service

Full self-service capabilities from onboarding to servicing, allowing your customers to manage their wealth. Seamless advisor handoff at any point during the customer journey.

Rich advisory engagement

Advisor-assisted interaction, either remote or in-person, as and when required, to support clients in their investment decisions, synchronized in real-time across all channels.

Our client partnerships

PostFinance, one of the largest banking institutions in Switzerland, worked with additiv to enter the digital wealth management market.

Hybrid wealth management

Support of self-service as well as advisor-led investment services.

Comprehensive product offering

Execution-only, advisory and discretionary mandates.

ATRAM, the largest independent asset and wealth manager in the Philippines, partnered with additiv to consolidate all client segments onto a single digital Wealth-as-a-Service (WaaS) platform to scale solutions for client-centricity.

Advisory-led digital wealth offering

Customizable advisory tools for individual, corporate and institutional clients.

Award-winning

Winner of IBSi Global FinTech Innovation Awards 2023 for Best Project Implementation.

Zurich Insurance, one of the world’s largest insurance groups, launched investment and retirement offerings to its clients with additiv’s end-to-end wealth-as-a-service platform.

Pension planning services

In-person and remote pension planning for pillar II and 3a.

Operational efficiency

Fully digitalized and automated end-to-end process and workflows.

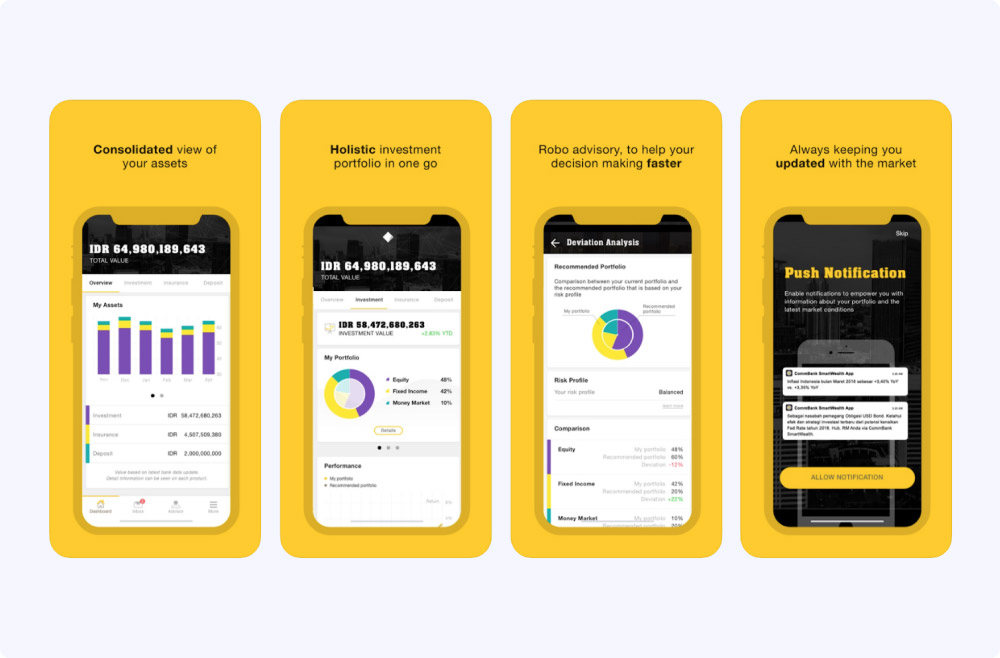

Commonwealth Bank Indonesia was the first bank in the country to launch a mobile banking application with investment features, CommBank Smart Wealth powered by additiv.

360° view of investments

Comprehensive interface enabling customers to directly monitor their total assets.

Self-service with on demand assistance

Manage investment transactions independently, freeing relationship managers and advisors to cater to the ones truly in need.

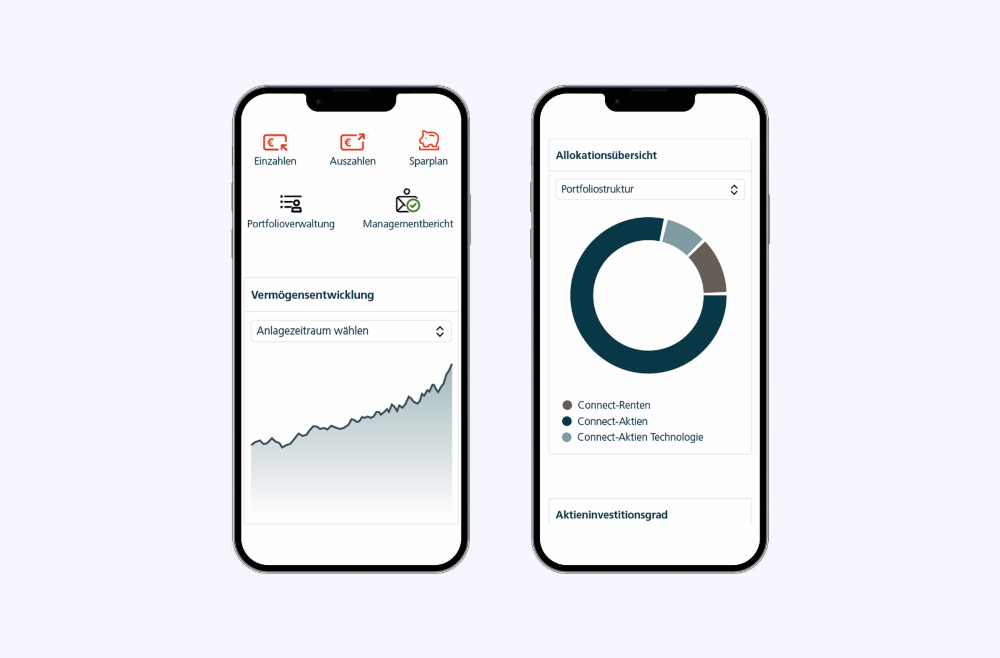

Deka, one of the leading asset managers in Germany serving the largest German retail banking group “Sparkassen”, uses the additiv platform for end-to-end portfolio distribution and omnichannel servicing.

Hybrid wealth management

Investment management and advisory services fully embedded into the saving bank's advisor and client portals.

Efficient processes

Intuitive digital onboarding journey with efficient and compliant advisor assisted onboarding and portfolio modification workflows.

Akbank AG, the German banking entity being part of Turkey’s leading banling group Akbank T.A.Ş., digitized the end-to-end investment and advisory services for advisor and clients on additiv’s platform.

MiFIDII compliant

MiFIDII onboarding and modification workflows for multiple client and investment types including investment advisory and execution only offerings.

Managed digital platform

Leveraging additiv's managed platform services for easy integration into partner systems and lean day-to-day operations.

PensExpert, a leading occupational pension provider in Switzerland, built a self-service pension offering, providing pillar 3a and vested benefits solutions, on additiv’s technology platform.

Pension solution

Self-service pillar 3a and vested benefits offering.

Process orchestration

Leveraging additiv's platform to orchestrate pension and wealth related services with multiple investment allocations.

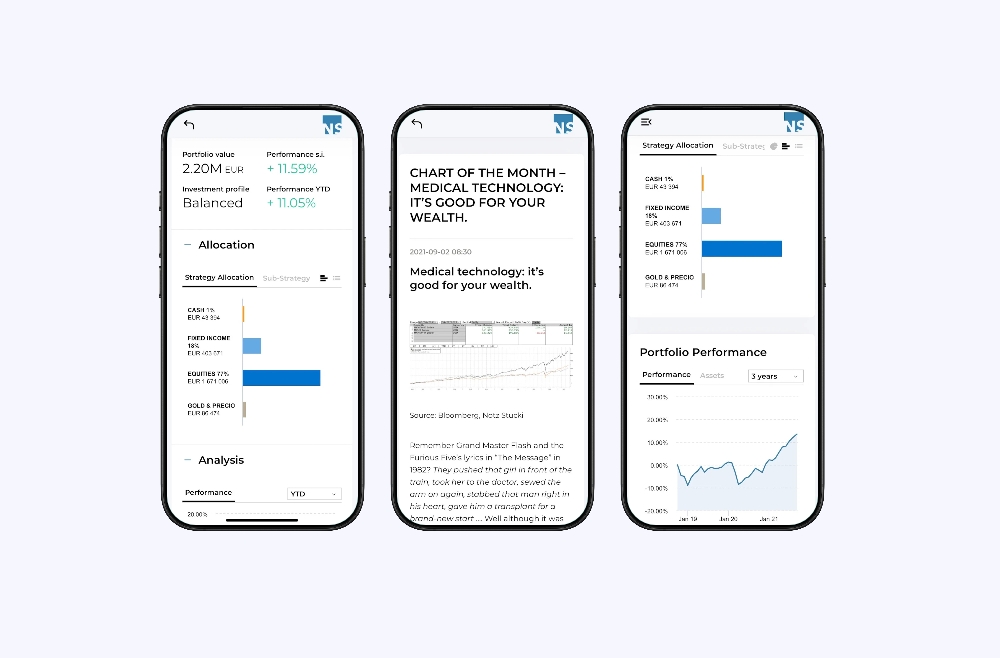

NS Partners, a global investment management firm providing bespoke wealth management solutions to private and institutional clients, partnered with additiv to provide a holistic, intuitive client cockpit.

Omnichannel advisory solution

Single core application to deliver easy access to investments and in-house market research.

Customer cockpit

Comprehensive overview and visualization of portfolios as well as direct market and investment news flow.