addInsurance by additiv

Enhance your offerings and propositions with embedded life and non-life insurance products sourced and orchestrated from the right insurance partners.

Embed insurance products and solutions directly into your existing customer journeys and touchpoints. Benefit from our curated marketplace or source from additional strategic partners.

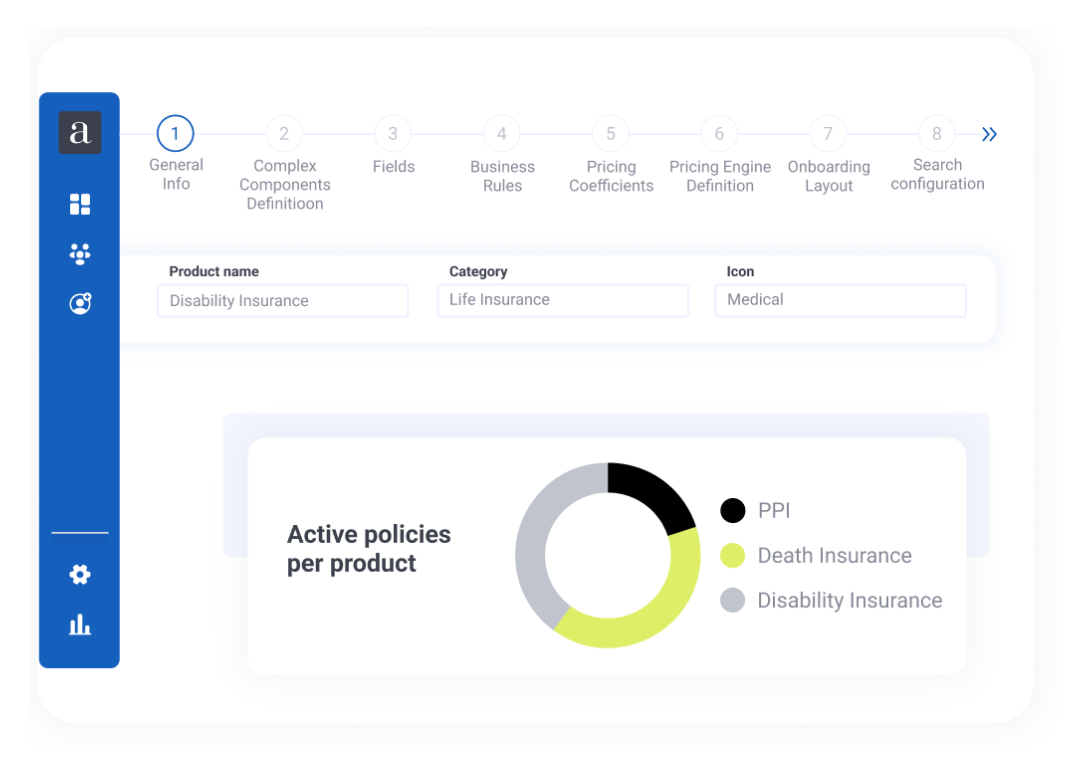

Our product builder, decoupled from the core systems, allows you to build tailored insurance solutions. Either as independent new product lines or complementary add-ons to your core products.

Unparalleled impact

Enhance your offerings and propositions with embedded life and non-life insurance products sourced and orchestrated from the right insurance partners.

Digitalized insurance offering and new distribution channels

Digitalized insurance offering

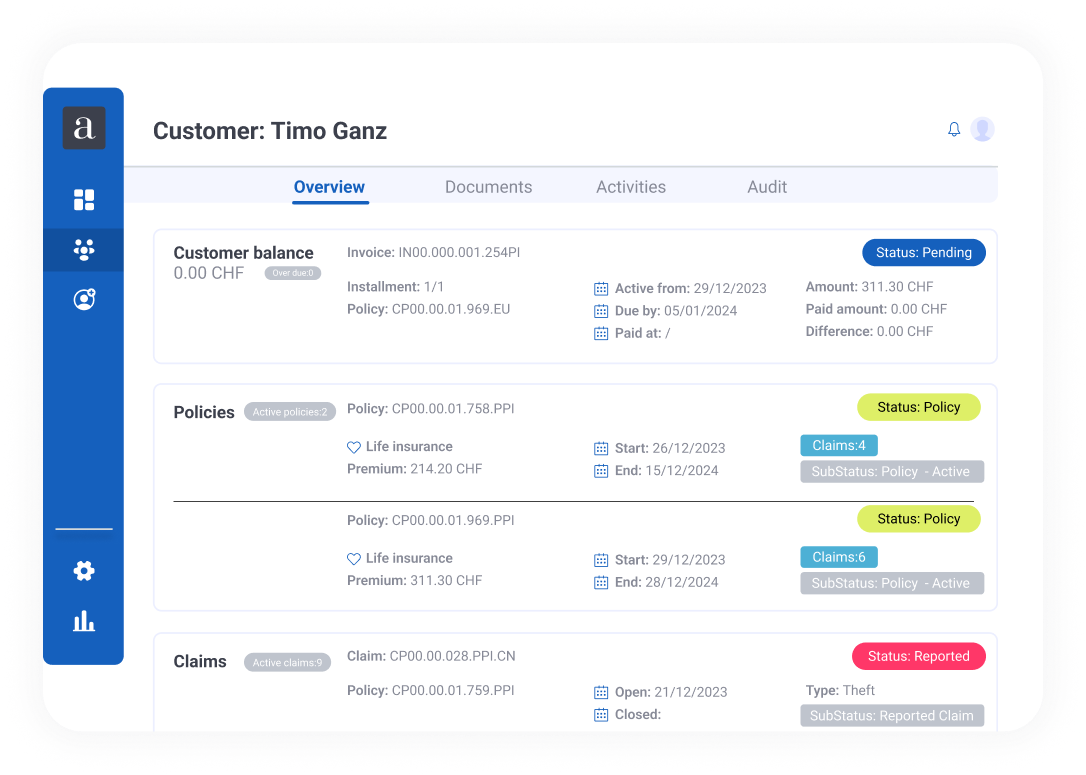

Transform your insurance offering through a single platform that integrates rich capabilities on product management, sales, customer & policy management, claims management and operations.

New distribution channels

Get access to new customers at lower acquisition costs by embedding your insurance offerings into third-party distribution channels and everyday consumer platforms.

Streamlined origination journey and minimal processing effort

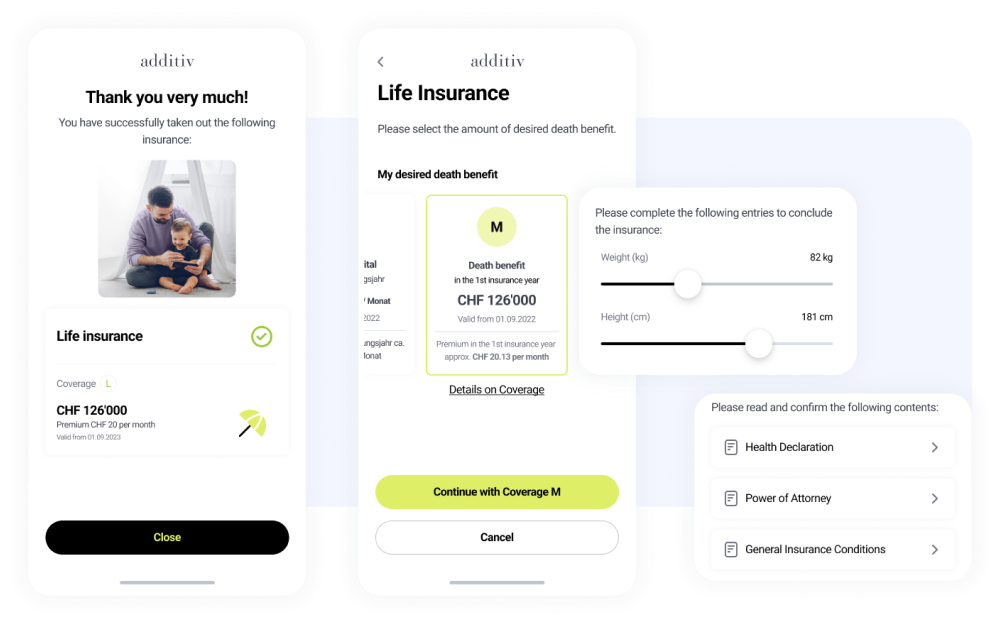

Simplified customer journey

Reduce processing efforts and seamlessly manage the full client journey on a single platform.

Open sourcing

Select or source from strategic insurers to create tailored insurance solutions for your customer base and channels.

Secure and protect your life

Secured financial future

Safeguard your family against unforeseen circumstances like unemployment, disability, or death.

Affordable and embedded

Personalized insurance solutions embedded in the client journey in the moment of truth.

Our client partnerships

additiv has worked with AXA insurance to build a plug & play platform that enables banks to offer complementary insurance solutions embedded into banking products.

Mortgage protection

This innovative solution allows banks to directly protect their mortgage customers against key risks.

Plug & play

As a seamless plug-and-play solution, addProtect gives banks direct access to the platform without the need for integration with existing IT systems.

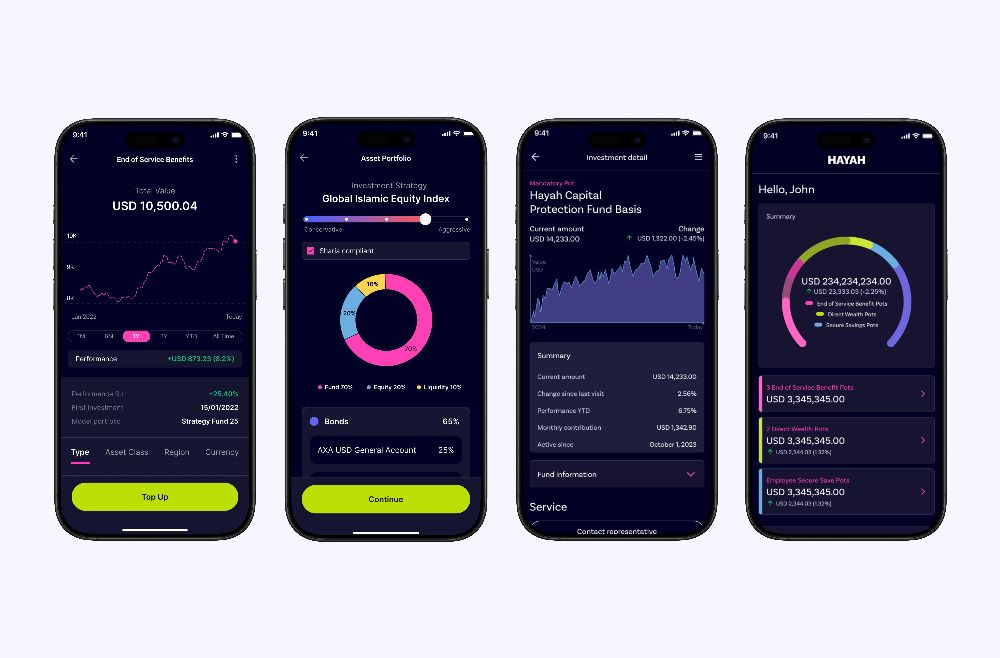

Hayah, one of the leading UAE Digital Insurance firms, launched a disruptive End-of-Service Benefits and direct wealth proposition on additiv’s platform.

End-of-Service Benefits

Fully digital employer and employee experience with risk-based Islamic & Conventional solutions and Capital Guaranteed option.

Direct Wealth

Direct to consumer wealth proposition with risk-based portfolios of funds and ETFs.