Featured success stories

Hayah, one of the leading UAE Digital Insurance firms, launched a disruptive End-of-Service Benefits and direct wealth proposition on additiv’s platform.

End-of-Service Benefits

Fully digital employer and employee experience with risk-based Islamic & Conventional solutions and Capital Guaranteed option.

Direct Wealth

Direct to consumer wealth proposition with risk-based portfolios of funds and ETFs.

additiv has worked with AXA Insurance to launch its addProtect bancassurance offering that enables banks to offer complementary insurance solutions embedded into banking products.

Mortgage protection

This innovative solution allows banks to directly protect their mortgage customers against key risks.

Plug & play

As a seamless plug-and-play solution, addProtect gives banks direct access to the platform without the need for integration with existing IT systems.

Deka, one of the leading asset managers in Germany serving the largest German retail banking group “Sparkassen”, uses the additiv platform for end-to-end portfolio distribution and omnichannel servicing.

Hybrid wealth management

Investment management and advisory services fully embedded into the saving bank's advisor and client portals.

Efficient processes

Intuitive digital onboarding journey with efficient and compliant advisor assisted onboarding and portfolio modification workflows.

ATRAM, the largest independent asset and wealth manager in the Philippines, partnered with additiv to consolidate all client segments onto a single digital platform.

Advisory-led digital wealth offering

Customizable advisory tools for individual, corporate and institutional clients.

Award-winning

Winner of IBSi Global FinTech Innovation Awards 2023 for Best Project Implementation.

PostFinance, one of the largest banking institutions in Switzerland, worked with additiv to enter the digital wealth management market.

Hybrid wealth management

Support of self-service as well as advisor-led investment services.

Comprehensive product offering

Execution-only, advisory and discretionary mandates.

Zurich Insurance, one of the world’s largest insurance groups, launched investment and retirement offerings to its clients with additiv’s end-to-end wealth-as-a-service platform.

Pension planning services

In-person and remote pension planning for pillar II and 3a.

Operational efficiency

Fully digitalized and automated end-to-end process and workflows.

Akbank AG, the German banking entity being part of Turkey’s leading banling group Akbank T.A.Ş., digitized the end-to-end investment and advisory services for advisor and clients on additiv’s platform.

MiFIDII compliant

MiFIDII onboarding and modification workflows for multiple client and investment types including investment advisory and execution only offerings.

Managed digital platform

Leveraging additiv's managed platform services for easy integration into partner systems and lean day-to-day operations.

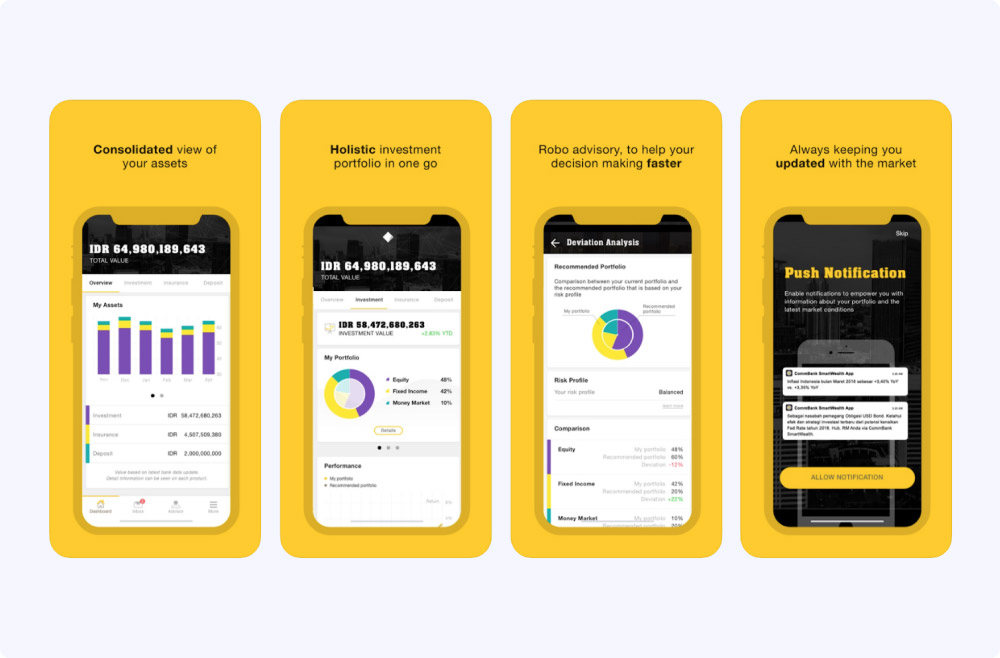

Commonwealth Bank Indonesia was the first bank in the country to launch a mobile banking application with investment features, CommBank Smart Wealth powered by additiv.

360° view of investments

Comprehensive interface enabling customers to directly monitor their total assets.

Self-service with on demand assistance

Manage investment transactions independently, freeing relationship managers and advisors to cater to the ones truly in need.

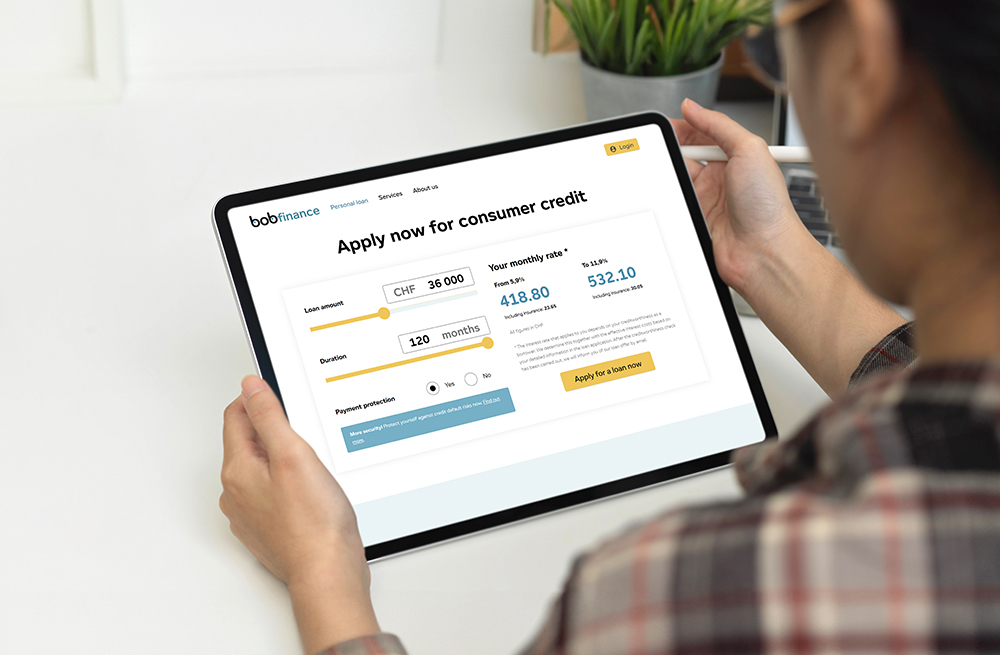

Developing a new financial services company for the retailer Valora targeting consumer finance market online and integrated at the POS.

End-to-end digital lending

From distribution, origination, refinancing till servicing on one digital platform.

Comprehensive business consulting

Business development from business case up to refinancing.

PensExpert, a leading occupational pension provider in Switzerland, built a self-service pension offering, providing pillar 3a and vested benefits solutions, on additiv’s technology platform.

Pension solution

Self-service pillar 3a and vested benefits offering.

Process orchestration

Leveraging additiv's platform to orchestrate pension and wealth related services with multiple investment allocations.

NS Partners, a global investment management firm providing bespoke wealth management solutions to private and institutional clients, partnered with additiv to provide a holistic, intuitive client cockpit.

Omnichannel advisory solution

Single core application to deliver easy access to investments and in-house market research.

Customer cockpit

Comprehensive overview and visualization of portfolios as well as direct market and investment news flow.