Part 1

In the world we live in today, change is a constant state of being. And financial services are no exception. In fact, in many ways, they are at the forefront of change.

Change is inevitable – except from a vending machine.

― Robert C. Gallagher

Over the past 30 years, banking technology has grown exponentially. But I believe that this is only the beginning and, with open banking enabling embedded finance and the inevitable swift progress in artificial intelligence (AI), the next 10 years will be revolutionary. As a result, we will see the principles of banking and the value they bring to consumers’ lives be completely reinterpreted. The position of financial institutions (FIs) will be unrecognizable. But how can financial institutions prepare when, in these uncertain times, IT project costs and constraints are at an all-time high?

Banks need to grow, but are investing less

According to Boston consultancy group’s 2023 report, the hurdle rate for most IT projects rose significantly in the first six months of 2022. With fears of a recession looming, their 2022 survey revealed that executives in financial services were more concerned than most, with some anticipating budget freezes and headcount reductions in their fields. But financial service providers can’t afford to stand still, especially as many needs IT transformation to remain relevant.

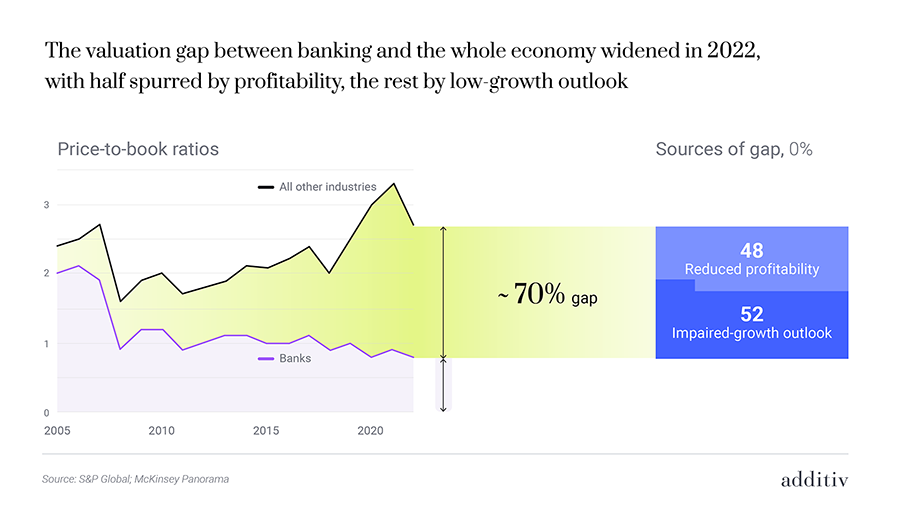

Over the last few years, we have seen a marked drop in market capitalization for a high proportion of traditional banking sector players. However, in contrast, specialist financial institutions and fintechs have seen a rise in market share (significantly up from their 30% share five years ago, [1] ).

A recent report from Mckinsey highlighted why many financial institutions are struggling and the potential challenges for those that are not: “looking not just at profitability but also at growth, we find that in addition to the 50%, which are destroying value now and are expected to continue doing so in the future, another 35% are currently creating value but are not able to grow sufficiently to ensure they will continue doing so. These are banks with high P/Bs but low P/Es. In other words, they are profitable now, but the longer-term expectations for future growth are not bright.” These statistics are frightening but, even for those wanting to address these issues, IT transformation projects can present their own challenges, many of which have historically resulted project scope limitations, and even a failure to progress.

Banks will need to become more resilient and reinvent their business models to ride out the current volatile period and achieve long-term growth and profitability.

― McKinsey’s Global Banking Annual Review, December 2022

The challenges of ‘sticking with a safe bet’

IT transformational projects are renowned to be career defining for C-level executives. However, often there are concerns that the risks may outweigh the benefits. A Forrester report demonstrated that a massive 52% of those banks that built banking technology completely inhouse missed their targeted timeline, and 45% came in more than 25% over budget. In particular, deploying basic infrastructure, designing client journeys and coding business logic and system logic was a major reason for project delays (81%).

These stats are not unique to just those banks that build inhouse. All too often, integrated systems from established vendors, which (in theory) improved efficiency, have hampered FIs in their quest to update business models in the light of new distribution channels and ecosystem opportunities.

In addition, there are multiple, cumbersome layers of decision making (politics, bureaucracy etc.), project scoping, analysis, the need to source and establish relationships and integrate with ecosystem partners etc. Add to this the fact that by the time an IT transformation project is underway, the technology being implemented is likely to be already outdated and it’s clear why FIs are struggling. The model must change.

An evolutionary, future proof model

Financial Services-as-a-Service (FSaaS) platforms are facilitating this change. Sometimes referred to as orchestration platforms, they are available via APIs, overcoming the need for expensive, time consuming and cumbersome projects.

These platforms bring together front-to-back capabilities, delivering them in a highly contextualized way, in the right form, at the point of need, in any channel. They enable FIs (as well as non-financial service providers) to seamlessly embed complementary products and services. These consumer distribution channels can offer these at the point of need within the customer’s digital journey. This negates the need for costly, time-consuming IT projects, allowing these distribution channels to offer innovative, agile, and more engaging solutions to meet individual customer segment or business needs.

It’s a model that allows ‘real options thinking’ to be realized. The concept of real options focuses on ‘keeping your options open’ for optimum value. It looks at what investors can do to capitalize on future uncertain events to more effectively target crucial opportunities to redeploy, delay, modify, or even abandon capital-intensive projects as events unfold. Enabling FIs to tap possible future cash flows without making a final decision to invest until the potential is confirmed makes real sense, and FSaaS platforms allow this. FSaaS ensures complete flexibility for future developments without risking huge IT project costs which might be wasted should the market, client need or business strategy change. In essence, it provides a higher level of value than traditional IT project models.

“Uncertainty creates opportunities. Managers should welcome, not fear uncertainty.”

― Real Options: Managing Strategic Investment in an Uncertain World Martha Amram and Nalin Kulatilaka

A resilient solution

A FSaaS model reassures C-Suite decision makers. It offers a strategic ‘bridgehead’ from which FI innovation is independent from active legacy platforms. But it also plays into the principles of data portability to an FI; enabling dominant platforms to make their services compatible with various networks and to make content and information easily portable between them.

Fully componentised, FIs can enhance product offerings and design new solutions instantly by literally switching functionality on and off. And because a FSaaS model is based on a single, orchestrated finance platform, one change can be applied to a single or multiple segments across the business. It’s as simple as having a hub and plugging in one or many ports, but the options are endless.

Furthermore, with this single platform new functionality and changes can be easily replicated. Removing the need to build individual solutions/platforms/products, a whole suite of products can be offered on one platform, with different capabilities. These can be turned on and off whenever needed; available quickly and easily to any segment or sub-brand when and wherever needed.

The equivalent of round wheels

A financial institution running on multiple systems is the equivalent of a cart with square wheels! Interesting imagery! It makes me wonder if we can take it even further? that a financial institution running without digital system is in square wheels / one running on multiple system is round wooden wheels / one on all terrain wheels is ready for any terrain/(options?)

A single platform is logical. It is the future. But as illustrated in the famous cartoon, the need for change can be difficult to comprehend, until the benefits are realized. However, for some this future will be embraced, and for others they will be too late – and they will be confined to the dark ages!

[1] McKinsey’s 2022 Global Banking Annual Review