This article first appeared in finews.ch on September 27th, 2021.

In 1988, hip hop group Public Enemy warned «don’t believe the hype». It’s a potent sentiment today – particularly in reference to embedded finance, or is it?

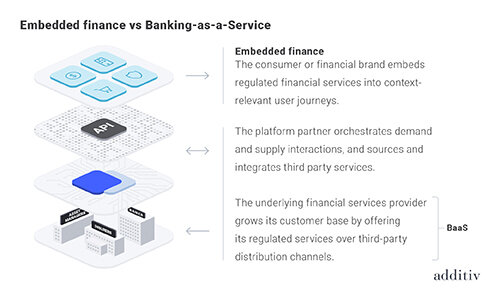

The term ‘embedded finance’ is becoming ubiquitous. It’s a financial services business model that enables customer needs to be put first, by offering them targeted products through any distribution channel at their point of context.

Many believe it’s a natural progression from open banking; which encourages data sharing amongst an ecosystem of players and APIs making it easier to interact across platforms. And with non-financial competitors, like Amazon, now offering their own financial services, there is no doubt that embedded finance is more than a trend – it’s the new norm.

Embedded at the Most Relevant Part of the User Journey

Embedded finance enables products to become integral parts of existing services, offered at the most relevant point. This is transformational because it removes friction and the cost of shopping around, which dramatically increases adoption. It’s no wonder that, according to industry expert Simon Torrance, embedded finance revenue opportunities overall are estimated to be worth $7 trillion by 2030.

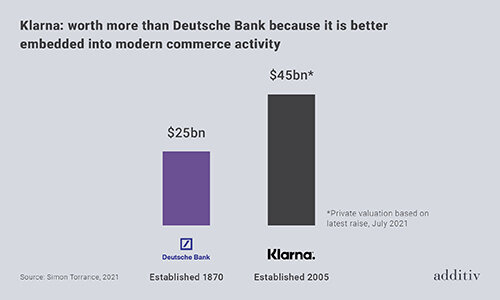

Take Klarna, a Swedish lender specializing in buy-now-pay-later credit. In 2020, it generated over $1 billion in revenue and reached a market cap of $45 billion.

However, real-world embedded finance examples tend to focus on areas such as buy-now-pay-later loans embedded into online checkouts, payments embedded into food-ordering apps or mobility, and travel insurance offered while booking a holiday.

Embedded Finance vs Banking-as-a-Service (BaaS)

But the opportunity hasn’t been lost on large incumbent banks either.

Universal banks, such as Standard Chartered and Goldman Sachs, offer BaaS platforms, Nexus and Marcus respectively, to capture this nascent opportunity and generate greater scale economies.

But, despite these examples, we’ve barely scratched the surface of what embedded finance can do. And, in particular, the opportunity for embedding wealth management services (embedded wealth) is huge.

The $100 Billion Revenue Opportunity

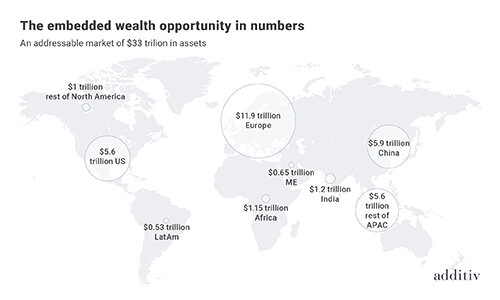

Embedded wealth is an untapped opportunity that could increase the investment market size by around a third i.e. $33 trillion in assets in the next 15 years globally. In our latest report, we translate assets into market size by revenues. We assume on average, wealth managers (and their partners) could earn 30 basis points for managing those assets – resulting in $100 billion fee potential.

The Embedded Wealth Use Cases

At additiv, we’ve identified six embedded wealth use cases:

- Retail and challenger banks, who are ideally placed to increase customer lifetime value by becoming the bridge to embedded saving and investment services.

- Employee financial well-being platforms, who can steer employees towards even better financial decisions, helping them manage their money more smartly while positioning themselves as a gateway to wealth management services.

- Asset managers, who can reach customers directly through online channels and bundle asset management with wealth management services.

- Health insurers, who have unique insights into their customers’ lifestyles, helping them save for a comfortable retirement.

- Pension providers and life insurers, who can bring siloed retirement and wealth decumulation services together into one unified, transparent process.

- Consumer platforms, whose strong customer engagement, rich data sets, and appeal to younger demographics, offer access to a largely untapped wealth management service audience.

When looking at our estimation and use cases, there is no doubt that embedded wealth is compelling. As with any market shift, the opportunity will be greatest for those who seize it first. If you want to get ahead, talk to us about capitalizing on this significant opportunity.