This article first appeared in Private Banker International, March 2021 edition

If you’re a keen follower of fintech trends, it won’t have escaped you that “Banking as a Service” (BaaS) has become a hot topic. But, it’s not always clear what people mean by BaaS or why it’s different from white-labelling.

Most people talk about BaaS in the context of lending and payments, but it applies to all of banking, including wealth management. So, in this article, we explain some of the basics of BaaS and introduce some possible use cases for wealth management.

What is Banking as a Service?

Banking as a Service (BaaS), also sometimes called embedded banking, is a term people use to describe banking services made available through Application Programming Interfaces (APIs) to other distribution channels. The distributor of the services, which is normally not a bank or financial services company, can either tightly integrate the banking service into its proposition – like the payment experience when you order a takeout from Uber Eats – or can just offer the service alongside its existing proposition, like a point-of-sale loan when you buy clothes from H&M.BaaS is different from white-labelling because it is API-based. This makes integration of the service more flexible and quicker, so there is no long lead time to embed a service, there is not a high technology switching cost in changing provider, and the distributor has more options to extend or brand the service.

Why is it so hyped?

The reason BaaS is so hyped is that it has the potential to massively grow the size of the banking market. By promising to provide consumers with the financial services they need at the time they need them, over the right channel, and tailored to their context, BaaS should much better match demand and supply and grow the overall market. According to Matt Harris, a VC at Bain Capital, the move to embedded banking will make banking akin to another layer in the digital stack and unlock more value than the three other layers – cloud, mobility and internet – put together; these represent a USD3.6 trillion opportunity (for the US alone).

Why it’s coming to wealth management

The underlying drivers of BaaS in payments and lending apply to wealth management. Technology has made it possible to divorce the manufacturing of services from the distribution of services. Now, consumers can access the services they want through the distribution channel that makes most sense, which will typically be the channel that is most convenient or has the highest level of engagement. For instance, if you’re chatting with a friend on WhatsApp and agree to send them a payment, it would be much more convenient to do so natively within WhatsApp than to have to separately open up your banking app, authenticate yourself, open up the payment screen, input your friend’s IBAN number and set up the payment. And so, it seems increasingly likely that banking will move to non-banking channels.

Why would this not also happen in wealth management? People cite that wealth management is an activity which requires high trust, which is true. However, many of the channels through which it might be distributed – such as via accountants – are also high trust intermediaries. Moreover, with wealth management, it is unlikely to become invisible in the way that some payments services will, and the underlying service and provider will still likely be branded. But, for the mass market and mass affluent segments, it will be difficult for wealth managers to create the same level of engagement or utility as some other channels, which means that wealth management will likely become more embedded into these channels.

Embedded wealth management can be a great opportunity. For those wealth managers that are open to these partnerships and position their services accordingly, this represents an expansion opportunity to open up parts of the market that remain underserved and difficult to access. Also, in addition to expanding distribution, it can also improve unit economics since the customers are already customers of the distribution partner and the cost of customer acquisition should therefore be lower.

The trick will be to make sure that the service remains sufficiently differentiated, even when distributed indirectly, that the wealth manager shares in the value creation.

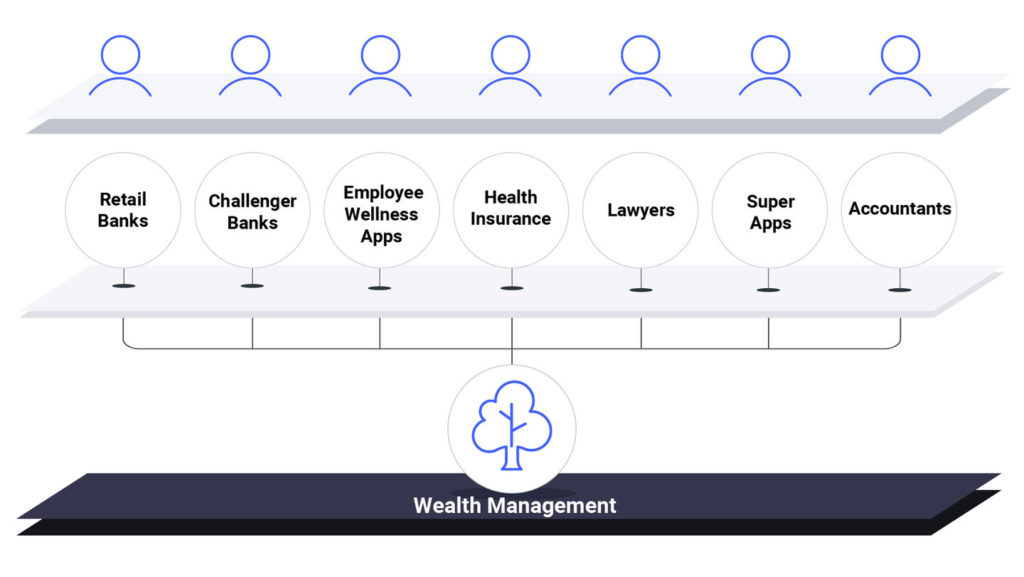

7 use cases where it could be a good fit

Accepting that embedded wealth management is likely to become more common and that, for wealth managers that embrace the opportunity, it could be a great expansion opportunity. We examine here what might be some of the potential partners and use cases, starting first with financial services before moving to non-financial services.

- Retail banks: the opportunity here is for retail banks to expand their value-add to existing customers. These retail customers oftentimes have large savings balances but for various reasons – including that these services are not available through their main bank provider – do not diversify out of low or zero-yielding savings accounts. But to embed a third-party investment service would allow customers to do so with minimal friction, improving their risk-weighted returns, while for the bank it would likely lower the risk of churn at the same time as generating fee income. Since PostFinance introduced investment services to its retail customer last year (albeit using own-labelled services), it has added about CHF30m a month in assets in under management.

- Challenger banks: the same is true for most challenger banks. They spend a lot of money on customer acquisition, but they do not have a wide service offering over which to amortize this high cost of customer acquisition, which means they struggle to be profitable. Also, they run the risk as their customers start to build savings that they will defect to another bank or, at the least, move their savings to another service provider. So, it makes sense to embed wealth management services alongside current account and savings products to generate fee income and lower the risk of churn. This is what some challenger banks are starting to do, such as Starling Bank, which offers its customers access to services like Wealthsimple and Nutmeg, and also Revolut which embeds brokerage services from DriveWealth. But more challenger banks should follow their lead.

- Employee wellness platforms: there is also an opportunity for employee financial wellness platforms to embed wealth management services. Most of these platforms, like Gusto in the US, start by helping employees to access their wages ahead of pay day. But almost all of them have or plan to add savings services, to help employees to set aside money. And from savings, it makes sense to add investment services since the employees are frequently visiting the platform and it would be convenient to manage investments alongside income and savings, but also because this is a natural and value-added cross-sell opportunity.

- Health insurance: the opportunity for health insurers to embed wealth management is about convenience, but it derives from data arbitrage. It’s about convenience because this is a channel that almost all adults use frequently to upload medical bills, claim repayments and make – and so there is already a surface area into which to embed other services. It derives from data arbitrage in that most of the data to calculate a health insurance premium can be reused to help individuals to make smarter decisions about their investments, removing friction from the upselling opportunity.

- Lawyers: this seems possibly more remote in that most interaction with lawyers is infrequent, such as when moving house. However, lawyers are present at many of people’s major life moments, including when making a will or when administering a person’s estate and implementing that will, and so they have occasion to acquire customers for wealth services and many more people have dealing with lawyers than investment managers. The only question is whether investment management would or could be “embedded” into a digital service.

- Super Apps: the super app, so-called because it aims to be the single app helping people to manage their digital lives, is much more prevalent in Asia than in Europe. The only notable super app in Europe is from Tinkoff in Russia. These apps, such as WeChat in China or Go-Jek in Indonesia, amalgamate dozens of digital services from peer-to-peer payments through to ride-hailing. The convenience of having so many services in a single app is high, but they also boast really strong engagement because there is integration between the services, enabling payments within the messaging app for example. As a result, the billions of users spend several hours in these apps every day, leaving a trail of data that then helps these apps to better match the users to other services that might be of interest or use to them. And so, the footprint of the apps increases over time, including to wealth management, which many of these services have launched or embedded into their apps. Distribution through a super app is clearly a massive distribution opportunity for a wealth manager, but it is also likely to be the most asymmetric relationship. The super apps have so much power relative to any one provider that it will be difficult, in our view, to extract good economic terms. We see the opportunity more that wealth managers that have high trust and engagement to embed other banking and non-banking services into their offering to become an aggregator or, if you will, a super app-light.

- Accountants: a much higher number of people use accountancy services than use wealth management services. They typically engage accountants to help with their personal or business tax returns, uploading documents or linking their bank accounts to a digital service so that the accountant can calculate what taxes are owed. By dint of this work, accountants have a unique access and insight into individuals’ income and wealth, which puts them in a strong position to embed wealth management into their service, especially where the customer has linked their bank account(s), providing an aggregated view of a customer’s financial life from which they can make investment decisions.

The BaaS landscape in wealth management

The BaaS landscape in wealth management is both fragmented and changing. There are a few banks, such as Goldman Sachs, that offer BaaS. But most incumbents banks and wealth managers do not and there is a clear opportunity to do so. There are also few BaaS players operating in wealth management. However, the existing SaaS providers to the industry, including additiv, are adapting their offerings to be able to support this, enabling wealth services to distributed through bank proprietary channels, but also to be distributed via third party channels using APIs. Furthermore, the same SaaS providers are also starting to work directly with the brands looking to embed wealth management, putting in place the partnerships with core banking providers and custodians to be able to offer an end-to-end regulated service.

What is your strategy for BaaS?

In this article, we have discussed BaaS and why it is such a major trend. It promises to open up a much bigger market for wealth management services and we have identified seven services into which it could be embedded. SaaS wealth management vendors are shaping their offerings to enable wealth services to be easily integrated into these and other distribution channels.

So, this begs the question: what is your firm’s plan for BaaS?