Spoiler alert: this successful collaboration led to a 25% increase in Premier Banking customers

Most changes in the financial industry aren’t sudden. They accumulate over time — just like interest — sometimes snowballing into massive shifts that end up changing the status quo.

By virtue of this principle, the 2008 crisis was not unforeseen and neither is what is happening now in the banking world.

For years, tech products have accustomed consumers with better usability, more features, increasingly convenient services, and greater flexibility. This became the standard by which customers judge their banking services. However, the pandemic just accelerated customer demands, meaning these gradual changes are not enough.

“Since the pandemic and social distancing, consumers have suddenly become accustomed to instant, seamless digital services. Anything less than this post-crisis won’t cut it.”

Michael Stemmle, additiv CEO and founder, The rising tide of Asia’s mass affluent demands a different approach

To the attentive observer, these shifts are not unexpected. Some financial organizations committed to serving their customers’ needs proactively choose to engage in the important work of making wealth management more inclusive and accessible even before circumstances became pressing. (However, even late arrivals can make up for lost time given proper help.)

At additiv, we’re delighted to work with such organizations. So today we’re sharing what we’ve helped PT. Bank Commonwealth achieve in Indonesia!

The company

With a history of over 20 years in Indonesia, PT. Bank Commonwealth (Commonwealth Bank) is a subsidiary of Bank Commonwealth of Australia (CBA), the largest service provider listed on the Australian Securities Exchange, also included in the Morgan Stanley Capital Global Index.

Commonwealth Bank provides customers with a variety of banking products in 25 cities across Indonesia such as savings, deposits, mortgage, various investment products and bancassurance, working capital credit for Small and Medium Enterprises (SME), and Safe Deposit Box (SDB), 24-hours Call Centre, as well as internet banking with special features that offer transaction flexibility.

The challenge

Operating in an opportunity-rich country such as Indonesia, PTBC (PT. Bank Commonwealth) not only identified what their customers needed in terms of wealth management but they also acted decisively to meet those needs.

In 2018, Commonwealth Bank wanted to provide their customers with a better, more inclusive wealth management service. As one of the banks that has the biggest number of mutual funds holders, the bank looked for a solution to serve their customers in a standardized and efficient manner.

Specifically, Commonwealth Bank aimed to ensure their customers have:

- An instant overview of their investments’ status

- Access to investment news so they can make better decisions

- The ability to do transactions by themselves so relationship managers can help those less digitally savvy.

To provide customers with the user experience and features specific to modern day fintech products, Commonwealth Bank needed a trusted partner to help them build these features into their offering.

“We always felt at that time there should be a way to serve all of our wealth management customers efficiently. This is where the technology came into the picture. We identified 3 fundamental needs customers have. The first one is to know anytime, anywhere their unrealized gain or unrealized loss of their investment. They usually asked their relationship managers to check how their investments are going. The second is that, in growing their investment, they needed to be updated with any recent news that affects their investment. This is another activity traditionally handled by relationship managers. And the third is the ability to do transactions themselves, without having to call the relationship manager to perform it.”

, says Ivan Jaya, EVP, Head of Wealth Management & Premier Banking

The solution

additiv stood out from the rest when Commonwealth Bank weighed their options, matching their six evaluation criteria:

- Proven capabilities through a deep product already available on the market

- Robust wealth management infrastructure

- Quality of design in terms of UX and UI

- An Agile approach to software development

- A representative/team located in Singapore

- A strong P&L and balance sheet.

“In today’s digital world, investors increasingly demand the ability to stay abreast of market developments and to manage their financial assets from their mobile devices. However, most financial institutions struggle with delivering this experience as they are tied up in a maze of legacy systems and disjointed service channels. PTBC recognised this challenge early on and entrusted the delivery of the platform for its mobile ‘SmartWealth’ service to us.”

, says Bert-Jan van Essen, Head of Business Development at additiv, The rising tide of Asia’s mass affluent demands a different approach

The collaboration with additiv started in March 2018 and deployed the 3-stage MVP in January 2019, making Commonwealth Bank the first to launch a wealth management mobile app in Indonesia.

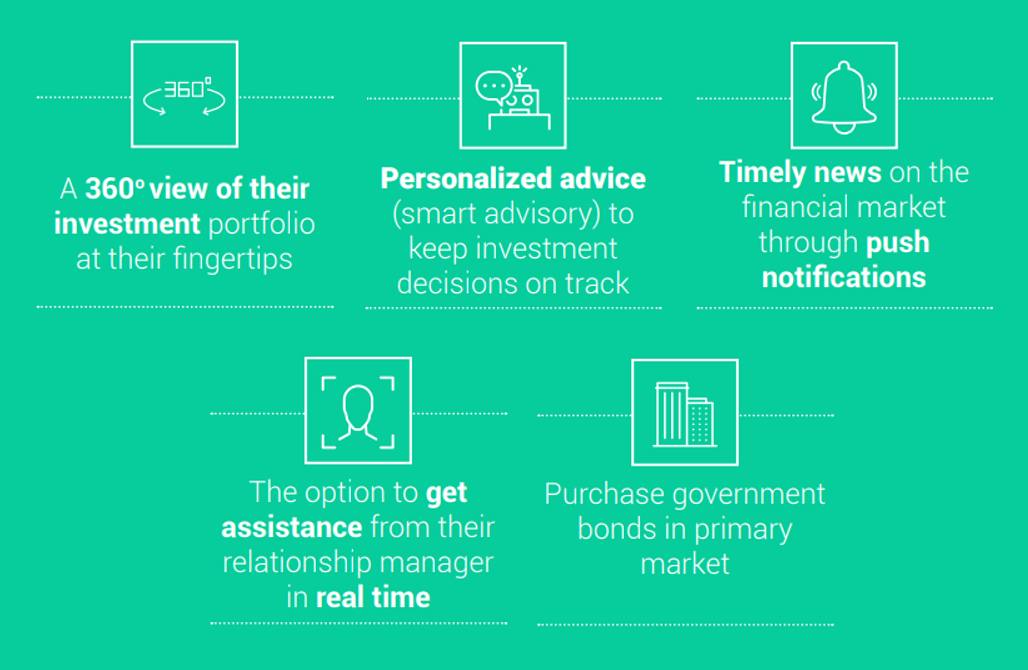

With CommBank SmartWealth, Indonesian customers now have:

- A 360° view of their investment portfolio at their fingertips

- Personalized advice (smart advisory) to keep investment decisions on track

- Timely news on the financial market through push notifications

- The ability to purchase government bonds in primary market

What’s more, starting July 2020, CommBank SmartWealth will also provide customers with the ability to purchase government and retail bonds directly from the app.

“Our customers really enjoy how we display their holdings’ status in the CommBank SmartWealth. The intuitive interface makes it easy for them to directly see their total assets and monitor their unrealized gain or loss. In addition to this, customer feedback deems the up-to-date market news they get through push-notifications as very useful. Plus, the goal-based investing feature packed with the robo-advisory function could be the game-changer.”

, says Ivan Jaya, EVP, Head of Wealth Management & Premier Banking

The result

Since launching the CommBank SmartWealth mobile app:

- Commonwealth Bank’s NPS registered an additional 26-point improvement

- Almost 25% of all Premier Banking customers have downloaded the SmartWealth app (up to June 2020)

- The number of Premier Banking customers increased by 25%, with the SmartWealth app as a key driver and the main element of the value proposition

- Commonwealth Bank Indonesia saved countless hours and helped customers get more value from their relationship managers, who previously spent efforts to combine a single customer’s holdings for a 360° update on their portfolio.

- The bank increased their scalability potential, no longer being limited by the finite human capacity of their relationship managers, who can focus on giving value-added advisory rather than spending their time in doing administrative tasks.

Commonwealth Bank won 3 major awards:

- The First Digital Banking Application that Integrates Comprehensive Wealth Management Product Information — the Indonesian World Record Museum (MURI)

- The First Digital Banking Application with Robo Advisory Service — the Indonesian World Record Museum (MURI)

- The 2019 Best Frictionless Customer Experience App — The Asian Banker.

“The rapid growth in the size of the mass affluent segment across Indonesia is reshaping demand for how financial services are delivered and used — PT. Bank Commonwealth in combination with additiv’s industry leading DFS platform is providing for that.”

, says Rajesh Narayanan, Head of Information Technology

“We are particularly proud of our partnership with PTBC whose vision and pioneering spirit we share. The launch marks an important milestone for the additiv that demonstrates our commitment to the Asia Pacific region and also the strength of our Digital Finance Suite Version 4, the technology underpinning SmartWealth.”

, says Michael Stemmle, CEO of additiv

Primed to navigate rocky waters

In spite of the current situation, the APAC region still holds incredible opportunities for financial organizations. Pre-pandemic forecasts anticipated the number of the mass affluent in Southeast Asia would double over the next decade.

While this growth may slow down, Asia’s fast-expanding middle-class population is still a fact. What’s more, their needs for cultivating wealth and financial planning are bound to increase.

“In addition, wealth managers will have to conform to growing demands for fairness and transparency that, post-crisis, will certainly increase as people call for better advice and greater value-add in managing their commercial and financial affairs.” Michael Stemmle, additiv CEO and founder.

Having invested in developing the SmartWealth app and the technical setup and processes that enable them to expand the app’s functionality or launch new products, PT. Bank Commonwealth is in a great position to reap existing — and future — ecosystem opportunities.

If you’re interested in discovering how additiv could help your organization maximize customer engagement to support growth, find out more about additiv or get in touch directly.